In today’s end-of-week review we break down the technical outlook for Ethereum, Ripple, Cardano, Binance Coin, and HYPE.

Ethereum (ETH)

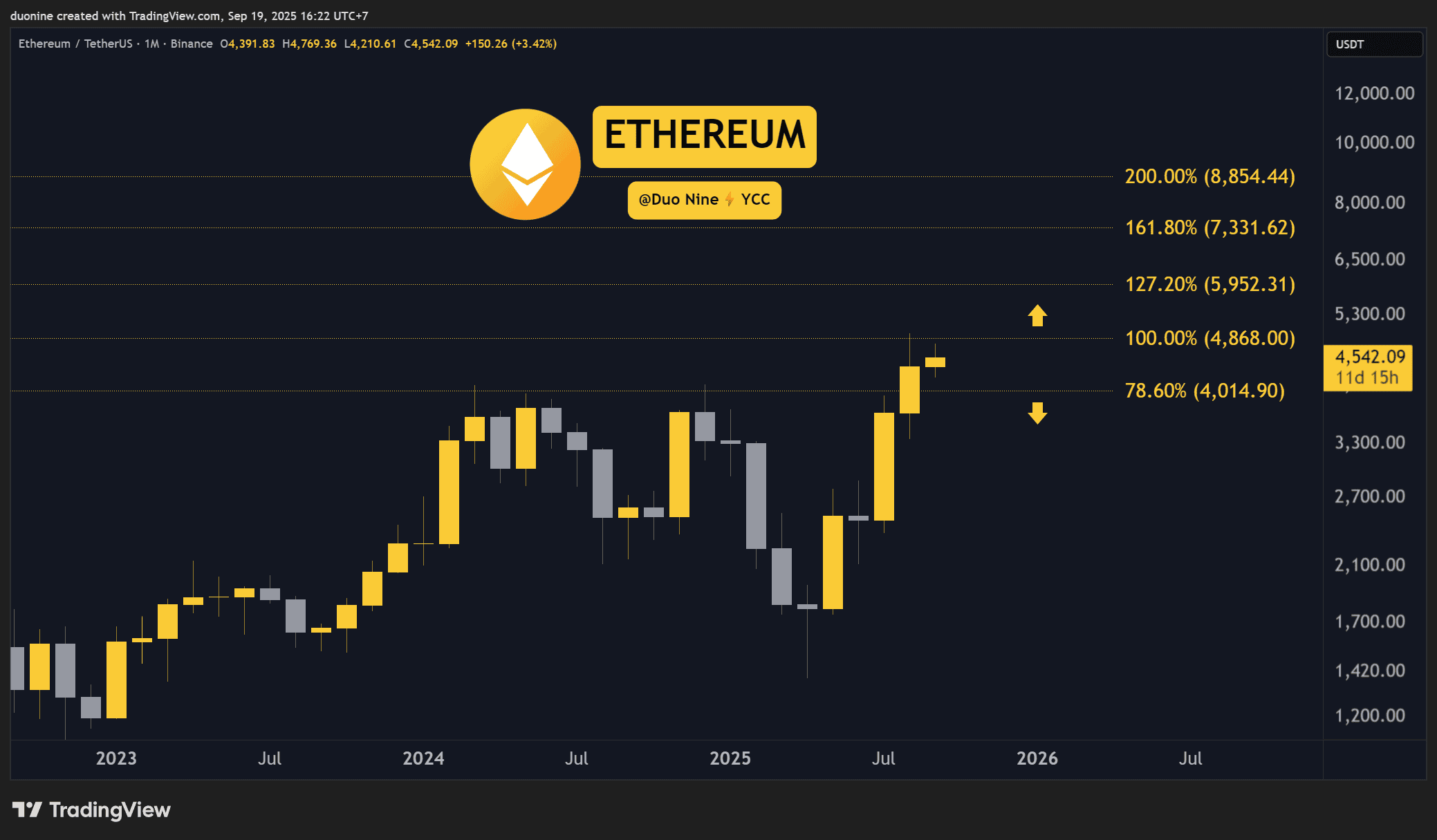

Ethereum finished the week trading near $4,500, showing little movement since our previous report. Since the start of August, ETH has been trading sideways: momentum has faded and trading volume is declining.

The coin remains confined to a broad range, capped by resistance around $4,868 and supported near $4,000. Until price decisively moves beyond one of these boundaries, meaningful directional action is unlikely.

The longer ETH remains trapped in this band, the more energy can build for a pronounced breakout when it finally occurs. Daily momentum indicators lean slightly bearish, but that bias won’t be confirmed unless the $4,000 support gives way.

Ripple (XRP)

XRP is mirroring ETH’s lack of direction, oscillating between roughly $3.00 and $3.20. Buyers managed to flip $3.00 into support in early September, but that bullish edge has weakened and price sits close to last week’s levels.

If demand does not re-emerge, XRP may revisit the $3.00 support. Multiple retests of a support often signal vulnerability and raise the odds of a breakdown. With dwindling volume and few buyers stepping in, sellers could take advantage.

To keep a bullish tilt, XRP needs to stay above the $3.00 mark; reclaiming and holding momentum above $3.20 would be required to restore stronger upside conviction.

Cardano (ADA)

Cardano pushed above $0.90 this week, but sellers are trying to force it back below that level. If they succeed, $0.90 will remain a resistance hurdle.

Despite the pushback, ADA closed the week up about 2%. That modest gain shows buyers are still present and could retake $0.90 as support, clearing the path toward $1.00 and higher.

ADA appears to be compressing in this zone; a larger directional move seems likely once one side gains control. Ultimately, either bulls or bears will determine the next leg for ADA.

Binance Coin (BNB)

BNB continued its strong run and reached a new milestone this week, briefly touching $1,007 — the token’s first four-digit close. That surge helped it finish the week with roughly a 10% gain, making it one of the better performers this year.

With $1,000 established, BNB’s next meaningful upside target is near $1,200. If buyers defend the $1,000 level, it could shift from psychological resistance into firm support.

The token is in price-discovery mode, and as long as the broader market remains constructive, higher levels are likely to be explored.

Hype (HYPE)

HYPE set a new high this week at $59, but most of those gains were erased within 24 hours as sellers stepped in. Buyers have pulled back to defend support zones around $56 and $52.

The $60 area remains a clear resistance that blocked the recent rally. Additionally, the daily MACD histogram is showing a bearish divergence, which raises the risk of a larger pullback.

Despite short-term volatility, HYPE is still recording higher highs on the bigger picture, keeping a bullish macro stance — a drop below $50 would undermine that outlook.