US spot Bitcoin ETFs lose more than $1.2 billion in a week, but Schwab CEO says client interest in crypto products is growing.

Bitcoin ETFs see record outflows, but Schwab sees surge in interest

US spot Bitcoin ETFs lose more than $1.2 billion in a week, but Charles Schwab reports rising investor interest.

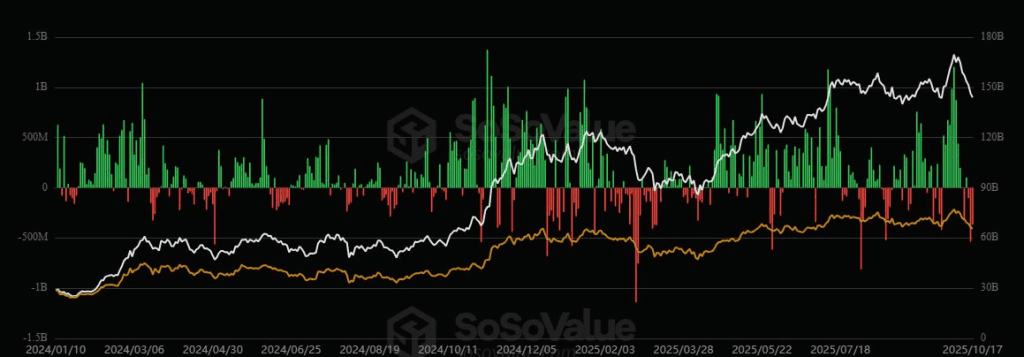

According to SoSoValue, $366.6 million was withdrawn from eleven funds on Friday, cementing the worst week for BTC-related products since the beginning of the summer.

BlackRock, Fidelity Lead Outflows

- BlackRock’s iShares Bitcoin Trust saw the biggest outflow, losing $268.6 million.

- Fidelity Wise Origin Bitcoin Fund fell $67.2 million, while Grayscale GBTC lost $25 million.

Other funds, including Valkyrie, saw little or no inflows.

Overall, net outflows for the week totaled $1.22 billion, with the funds seeing a small inflow on Tuesday alone.

The decline coincided with bitcoin’s price falling from more than $115,000 to $104,000, a four-month low.

Schwab: Crypto products are gaining popularity

Despite the market downturn, Charles Schwab CEO Rick Wurster remains bullish.

He said the company’s clients own 20% of all crypto ETPs in the US, and visits to its crypto products page have increased 90% year-over-year.

“This is a topic that is generating tremendous interest,” Wurster said on CNBC.

Analyst Nate Geraci emphasized that Schwab is one of the largest brokerages in the country, so its interest in crypto ETFs is an important signal to the market.

The company already offers crypto ETFs and bitcoin futures, and by 2026 plans to open full-fledged spot trading in digital assets.

October breaks historical trend

According to CoinGlass, bitcoin has grown in ten of the last twelve Octobers, but it has already lost 6% this year.

Analysts, however, expect the second half of the month to resume “Uptober,” especially if expected Fed rate cuts push investors into riskier assets.

Related: Bitcoin ETFs Raise $2.7 Billion in a Week Despite Trump’s Tariff Threats