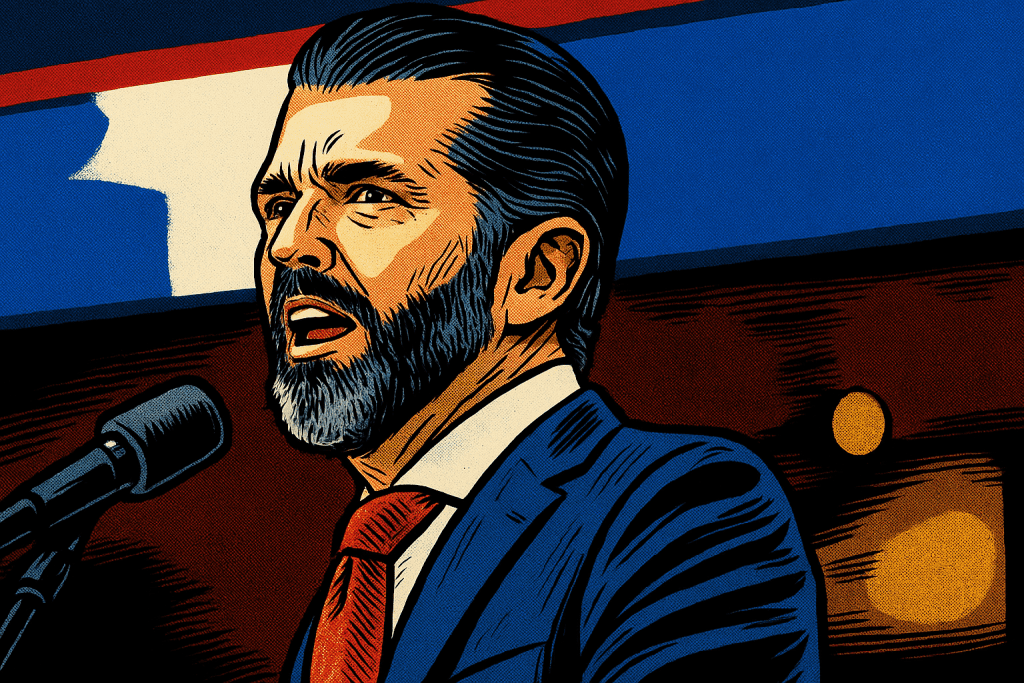

Donald Trump Jr. is taking on a bigger role in the prediction markets sector, announcing Tuesday that he is both investing in Polymarket and joining its advisory board.

The investment is being made through 1789 Capital, the venture capital firm where Trump Jr. serves as a partner. Terms of the deal were not disclosed, but the company called it a “strategic” investment. “Polymarket cuts through media spin and so-called ‘expert’ opinion by letting people bet on what they actually believe will happen in the world,” Trump Jr. said in a statement. “I am pleased that 1789 Capital is investing in Polymarket and am honored to join the company’s advisory board.”

Trump Jr.’s move is notable as he is also advising Kalshi, Polymarket’s chief rival. He joined Kalshi as a strategic advisor in January, meaning he now has ties to both platforms competing in a fast-growing sector.

Prediction markets surged in popularity during the 2024 U.S. election season, as voters and speculators used platforms like Polymarket to wager in crypto on the outcomes of races. Both Polymarket and Kalshi reached the top of Apple’s App Store finance rankings on the eve of the election, boosted by high-profile endorsements, including one from Elon Musk, who called prediction markets “more accurate than polls.”

Polymarket, which brands itself as the world’s largest predictions platform, has had regulatory hurdles in the past. In 2022, it paid a $1.4 million fine to settle with the Commodity Futures Trading Commission (CFTC) for allegedly offering illicit binary options. As part of that agreement, the firm pledged to block U.S. users until it could return in compliance with regulations.

That return is now imminent. Last month, Polymarket said it acquired QCEX, a CFTC-regulated derivatives exchange, for $112 million, paving the way for a U.S. relaunch.

Meanwhile, Coinbase and Robinhood are also exploring prediction market products, signaling broader interest from mainstream crypto and financial firms.