After the fee reduction, Tron block producer revenues fell by 64%, but the network still generates over 90% of revenues among L1s, ahead of Ethereum and Solana.

Tron reduced fees but maintained leadership among L1

The recent reduction in fees on the Tron network has hit block producers, known as Super Representatives, hard. According to CryptoQuant, daily fees fell to $5 million as of September 7, the lowest in more than a year and 64% below the level seen just ten days ago ($13.9 million).

Why Revenues Drop

The drop is due to the passage of Proposition 789, which reduced the price of an energy unit from 210 to 100 sun. As a result, the average transaction fee has decreased by about 60%. One TRX is equal to one million sun.

The initiator of the proposal, a member of the GrothenDI community, explained that reducing the cost of gas will help “ensure the sustainable and healthy development of the Tron ecosystem.” He also predicted an additional 12 million potential transactions from users due to the reduction in fees.

Competitive Position

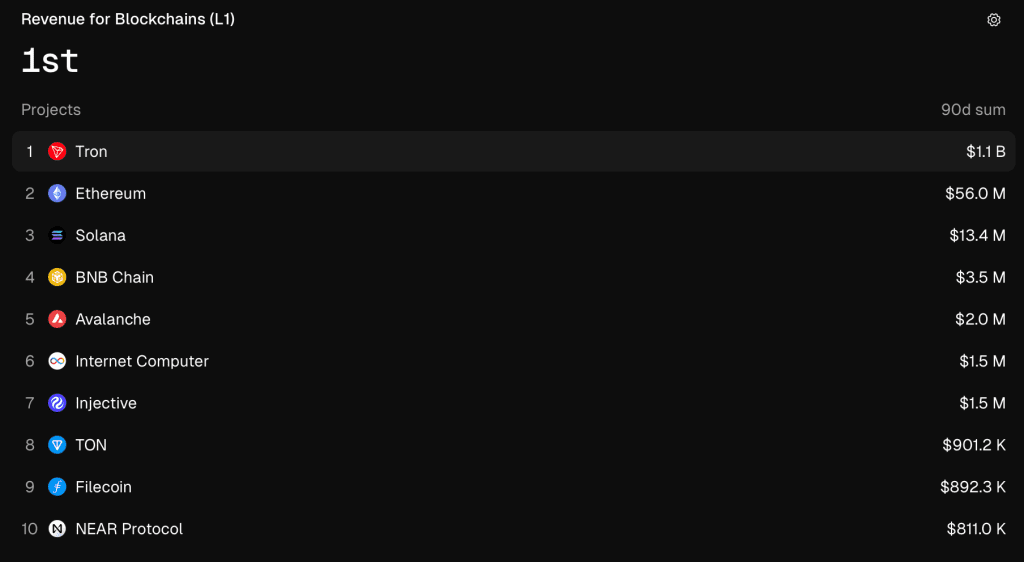

Despite the decline in block producer revenues, Tron remains dominant among the first-level blockchains. According to Token Terminal, the network generated 92.8% of all L1 revenues in the last seven days, ahead of Ethereum, Solana, BNB Chain and Avalanche.

Over the past 90 days, the network’s fee volume exceeded $1.1 billion. At the same time, Ethereum has received $13 billion in fees, while Tron has received $6.3 billion over 5 years.