Crypto execs warn that tokenized equities expose investors to double volatility and hacking risks, as SEC and Nasdaq explore round-the-clock markets.

Industry leaders warn of risks in tokenized stock trading

Digital Asset Treasury (DAT) companies that tokenize their shares on the blockchain are creating double the risks for investors and their own businesses. As Kadan Stadelmann, CTO of decentralized exchange Komodo, explained, blockchains operate 24/7, while traditional markets have strict business hours. This means that sharp price movements during off-hours can cause a “run” on the shares of such companies, when they simply do not have time to react.

In addition, smart contract vulnerabilities, possible hacks and exploits that put both the company’s assets and the tokenized shares at risk are added to the risks.

“Synthetics on top of synthetics”

According to Kani Lee, CEO of SecondSwap, the tokenization of DAT shares “creates synthetics on top of synthetics.” It’s a double exposure: investors are simultaneously exposed to the volatility of the cryptocurrency and the complexity of corporate law, governance and securities regulation.

“This is too much risk imposed on an already volatile asset,” Lee concluded.

SEC and exchanges prepare for 24/7 market

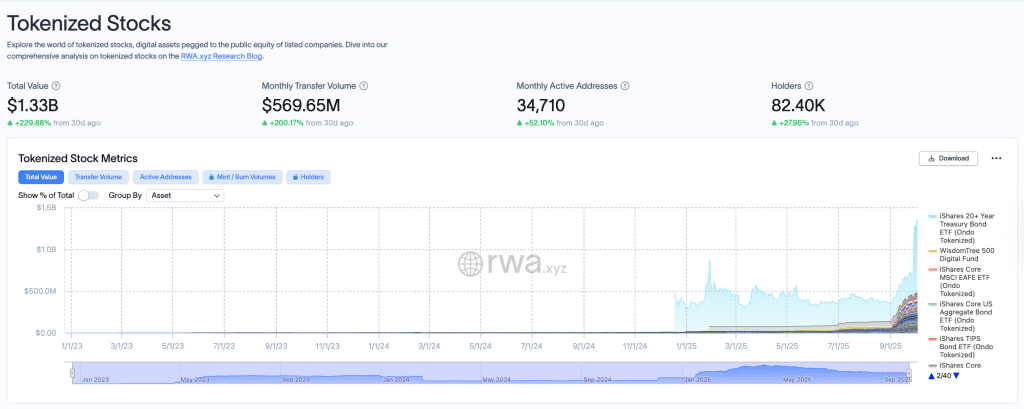

Despite these risks, the idea of tokenized stocks is gaining momentum: their total value has already exceeded $1.3 billion. In the US, the SEC is considering options for launching blockchain-based stock trading to modernize the traditional system, which is “closed” on nights & weekends and has long clearing times.

The regulator is discussing the possibility of allowing licensed crypto exchanges in the US to offer tokenized stocks to retail investors.

Nasdaq plans 24/5 trading

At the same time, traditional exchanges also do not want to lag behind the crypto market. Nasdaq has already announced plans to launch trading 24 hours a day, 5 days a week, starting in the second half of 2026. The NYSE is also exploring this option to attract a new generation of investors accustomed to continuous markets.

Related: Tokenized Stocks Highlight Significant Tax Reporting Challenges in Cryptocurrency—Robin Singh