Sonic Labs has won overwhelming community approval for a bold U.S. expansion plan aimed at bridging into traditional finance.

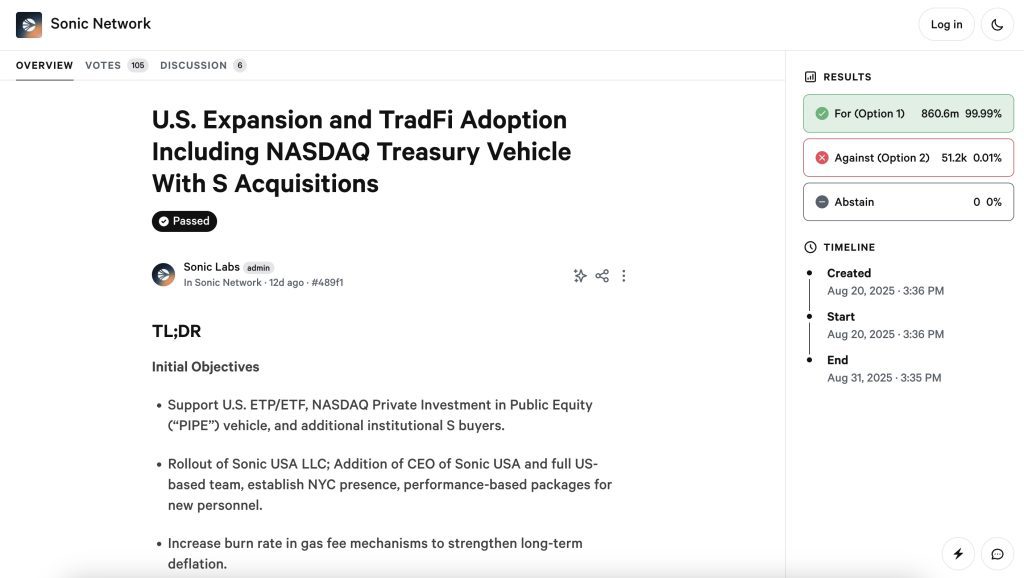

On Aug. 20, the blockchain firm passed a governance proposal titled “U.S. Expansion and TradFi Adoption” with 99.98% backing. The initiative authorizes the issuance of $150 million worth of its native S token to fund a push into U.S. capital markets.

The strategy involves partnering with a major ETF provider to launch a regulated fund tracking the S token, with $50 million earmarked for liquidity and operations. Another $100 million will support a Nasdaq private investment in public equity (PIPE), creating a strategic reserve for a Nasdaq-listed vehicle. That reserve will purchase S tokens on the open market and through OTC trades, with all tokens locked for at least three years — a move designed to bolster credibility and signal long-term commitment.

Alongside the financial initiatives, Sonic Labs is forming a U.S. entity, Sonic USA LLC, headquartered in Delaware. The subsidiary will focus on regulatory compliance, Washington D.C. engagement, and executive hires to lead the American effort. To fund these operations, the company plans an additional 150 million S token issuance, separate from the $150 million allocation already approved.

“The focus is to drive adoption and growth and lead engagement in Washington D.C.,” the proposal stated, pointing to rising institutional demand for exposure to the S token in the U.S.

Beyond the U.S. push, Sonic Labs also proposed tokenomics changes, including burning a portion of gas fees to make the S ecosystem more deflationary.

The move comes one year after Sonic’s rebrand from the Fantom Foundation and the launch of its EVM-compatible Layer 1 blockchain. At present, S trades at $0.31 with a market capitalization of $892 million, according to CoinMarketCap.