In this Friday update we take a closer look at price action and important support/resistance levels for Ethereum, Ripple, Cardano, Binance Coin and HYPE.

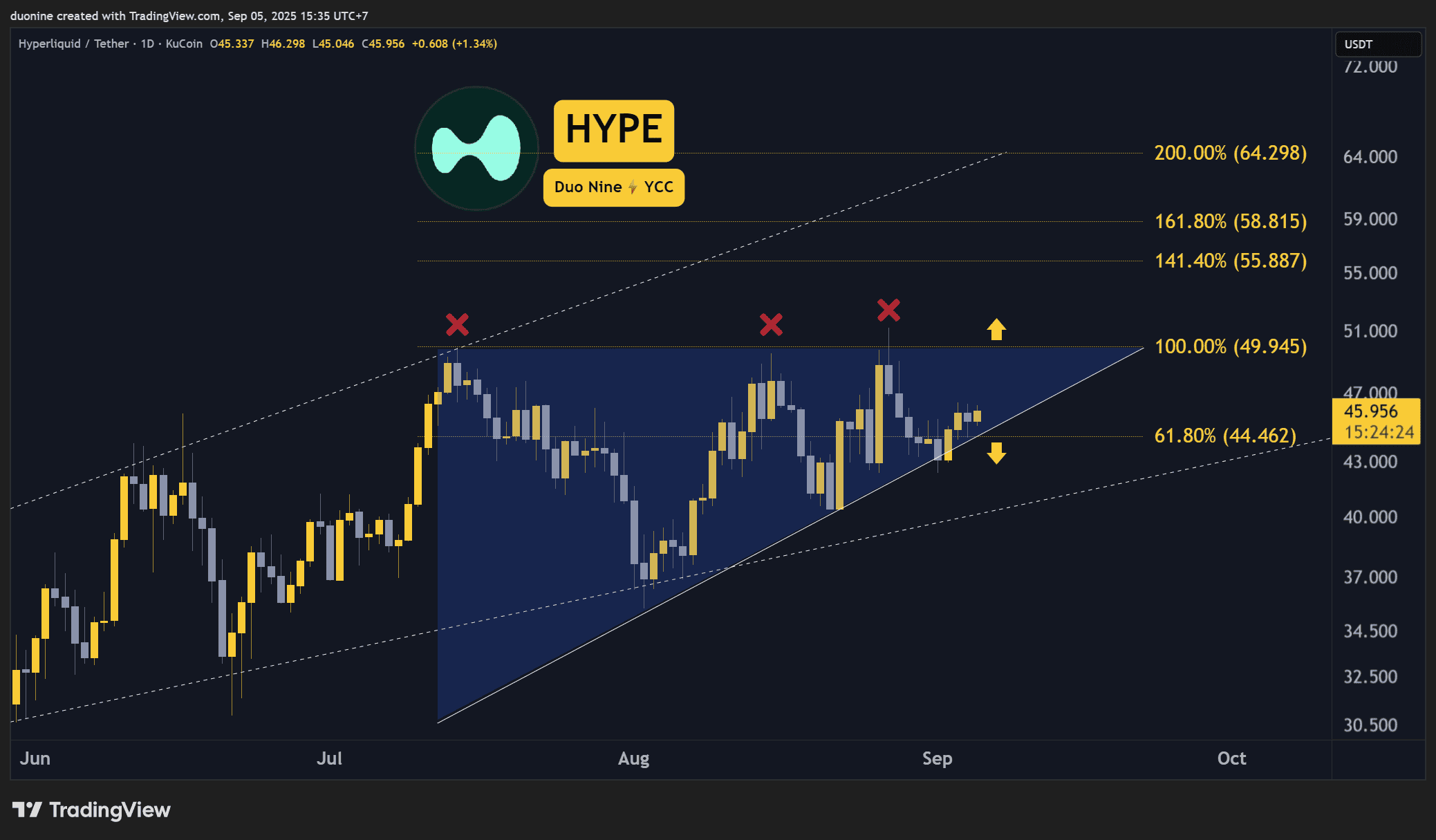

Ethereum (ETH)

Ethereum has traded mostly sideways over the past week, finishing about 1% higher than seven days ago. The recent range is marked by declining volume and muted volatility, though that calm likely won’t persist indefinitely.

Immediate resistance sits around $5,000, while a critical support level near $4,000 has already been tested. Since mid‑August ETH has been locked in this wide trading band as bulls and bears vie for control.

Technically, the market looks like it’s consolidating after a strong summer run. If buyers regain momentum once the pause ends, ETH could break out and continue price discovery above the $5,000 level.

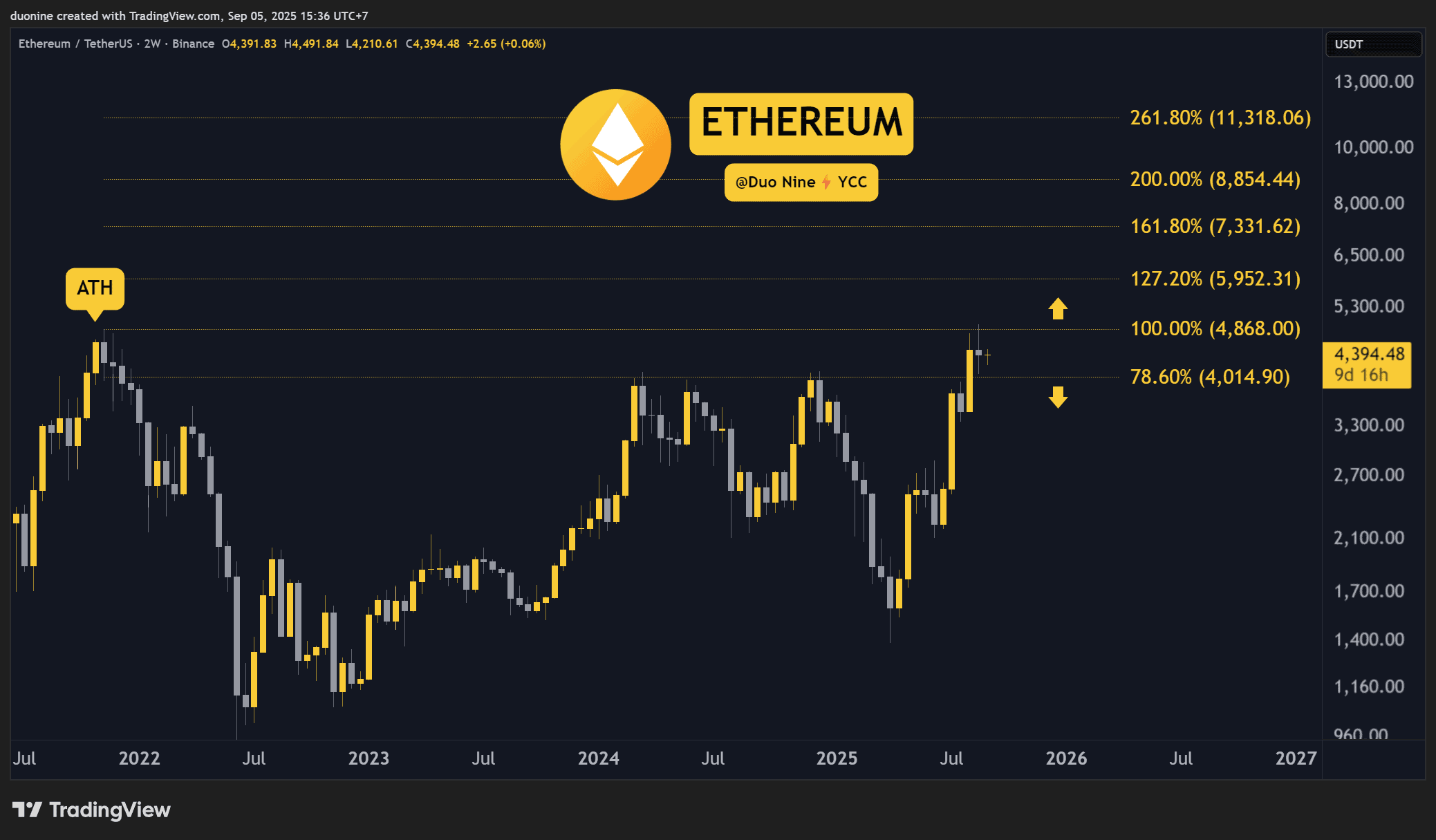

Ripple (XRP)

XRP remains in a downtrend and has carved out a large descending triangle whose horizontal base sits at roughly $2.70. So long as that support holds, the token retains a reasonable chance of staging a recovery and potentially resuming an upward move.

The asset ended the week down about 1%, a modest setback that isn’t alarming if the $2.70 area remains intact. The small drop does indicate hesitation among traders as they await a clear breakout.

With pressure building inside the triangle, volatility could return soon. Price action should reveal whether sellers keep control or buyers finally push XRP out of the pattern.

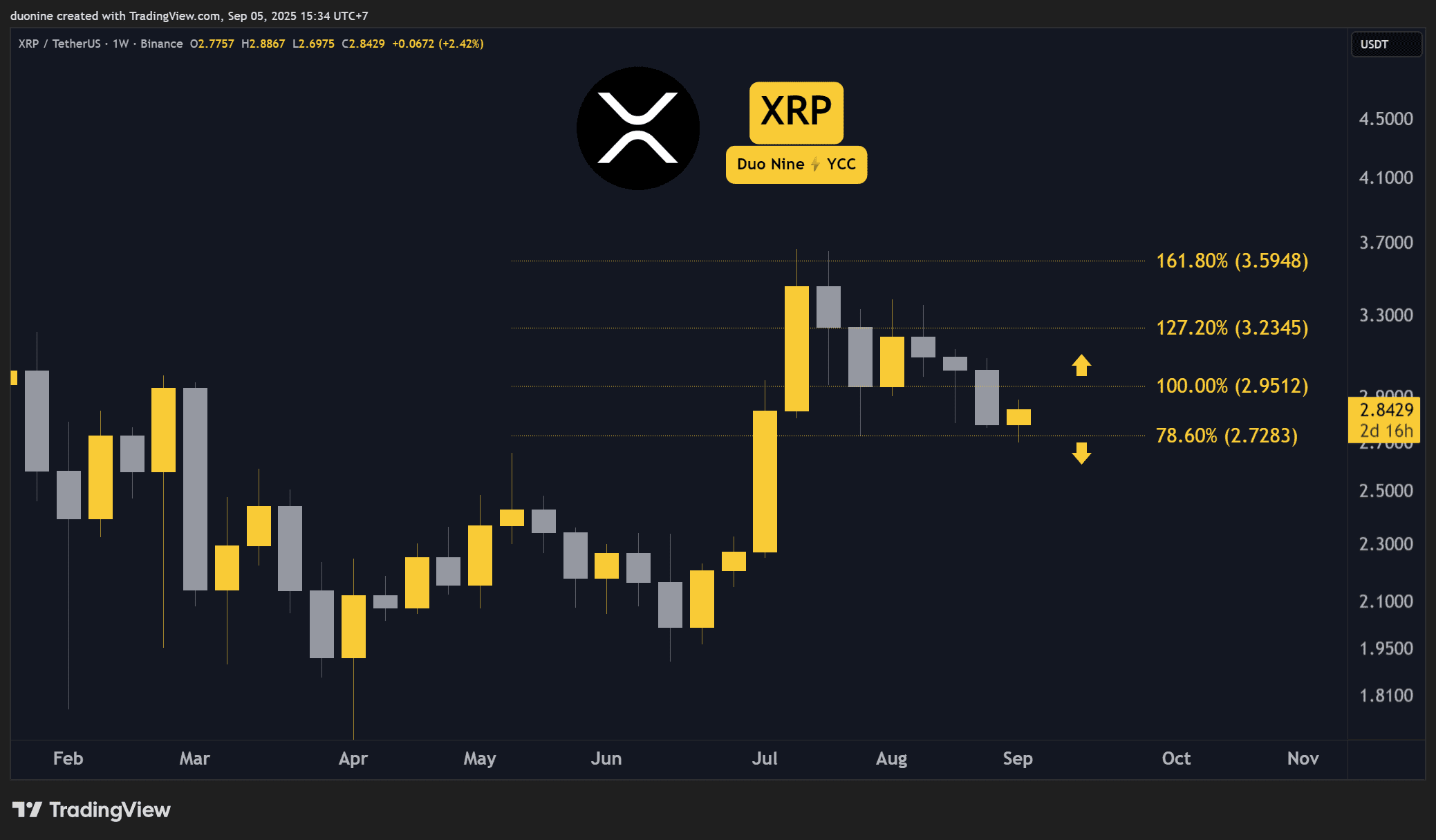

Cardano (ADA)

Cardano appears to have found support around $0.78, with buyers showing signs of forming higher lows. If that pattern holds, ADA may renew its attempt to challenge the resistance near $0.90, which has capped moves in the past.

ADA closed the week up roughly 1%, trading sideways above the key support. Trading volume has contracted since mid‑August, which helps explain the subdued volatility observed recently.

Looking forward, bulls could try to push ADA through the $0.90 ceiling. A successful breach would open the path for a renewed move toward and above the $1.00 mark.

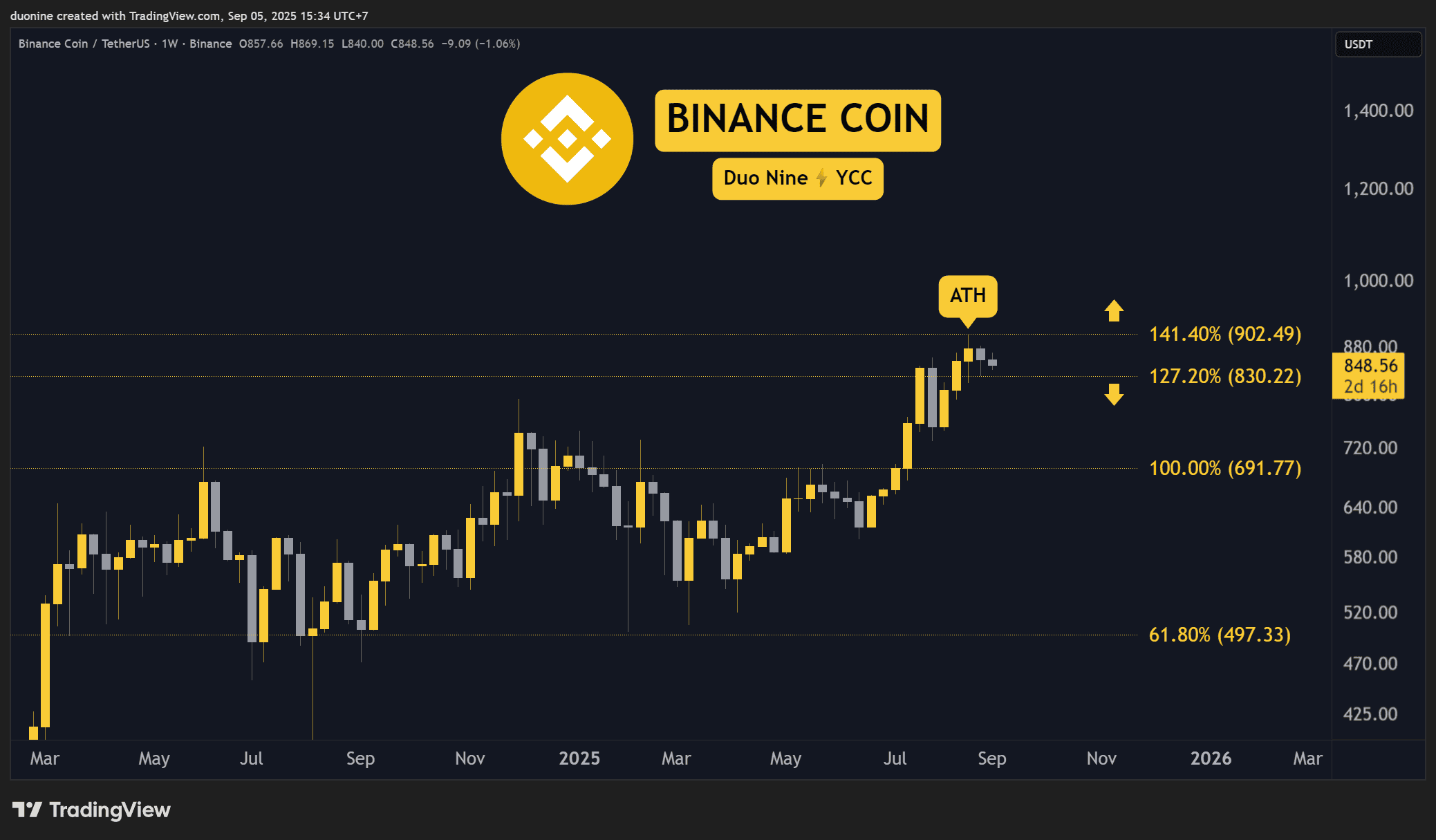

Binance Coin (BNB)

BNB was largely flat over the last week, trading close to levels from our previous update. The coin remains supported near $830; as long as that level holds, higher targets remain in play.

The primary resistance to watch is at $900 — the recent all‑time high reached in August. Maintaining support above $830 would make another run at that $900 zone more likely.

Assuming buyers can clear the $900 hurdle, BNB stands a solid chance of testing $1,000 in 2025, putting it among the altcoins that could keep making higher highs this year.

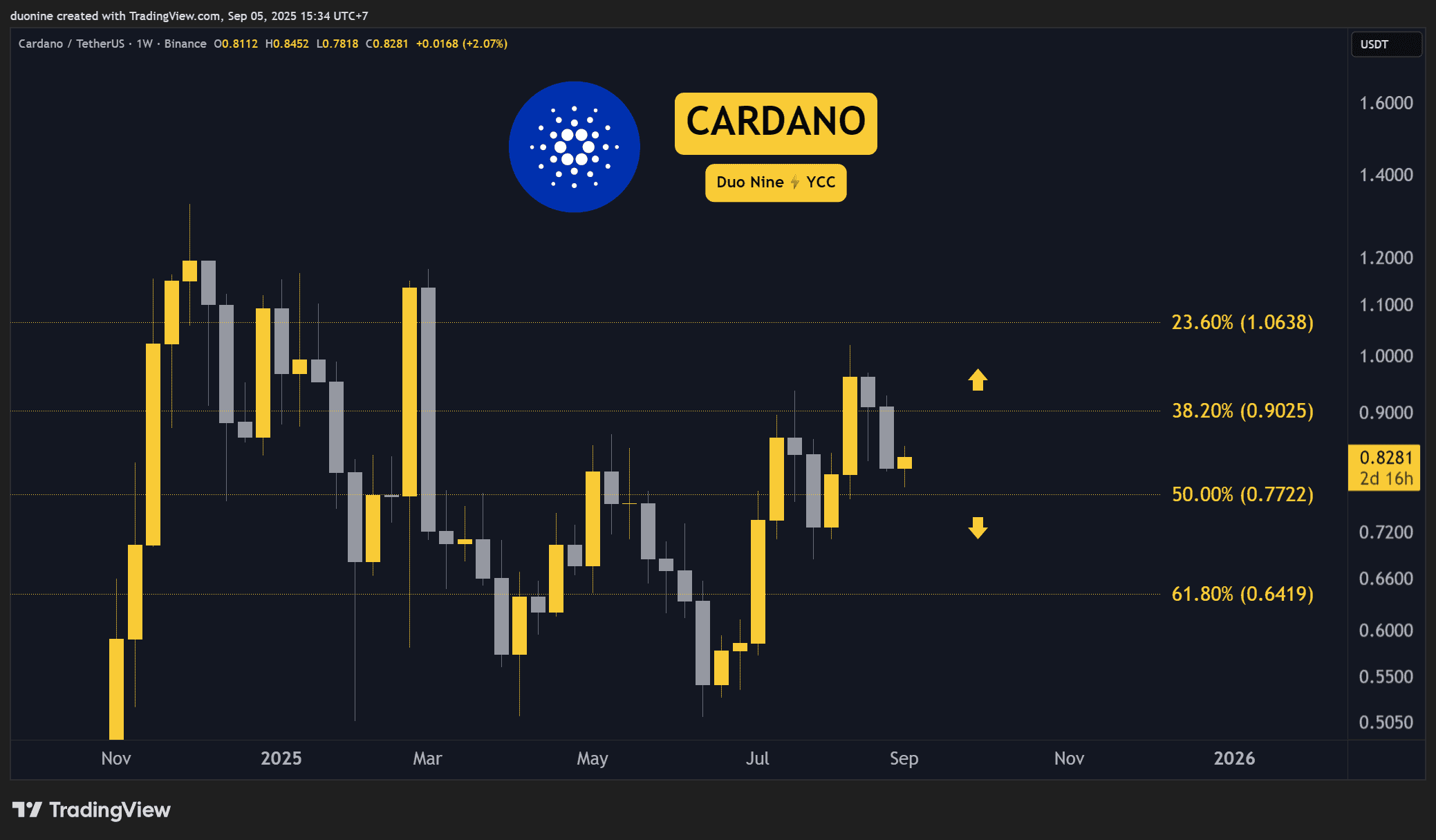

Hype (HYPE)

HYPE gained roughly 5% this week and has held above a key support near $44. Despite the weekly rise, bullish momentum has cooled compared with prior months, partly because the $50 level has rejected price on three separate occasions.

Holding the $44 support is important; a break lower would likely attract sellers. For now the token is oscillating between $50 and $44, which looks like consolidation.

HYPE faces a decision point by mid‑September as its time inside a large ascending triangle (shown on the chart) comes to an end. A decisive breakout — up or down — is probable once the pattern resolves.