This Friday we take a closer look at the price action and key levels for Ethereum, Ripple, Cardano, Binance Coin and HYPE.

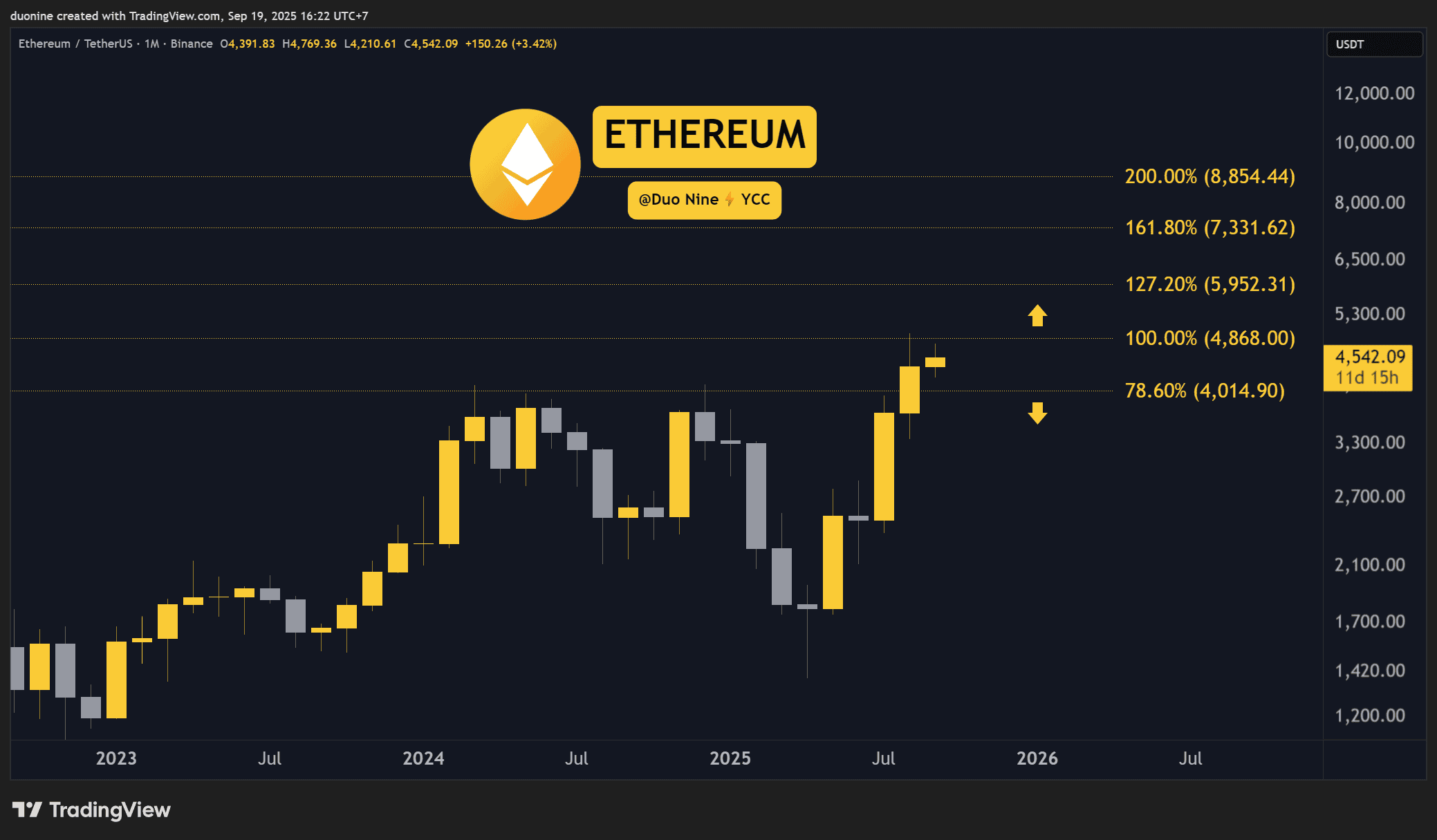

Ethereum (ETH)

Ethereum finished the week near $4,500, showing little net change from our previous update. Since early August ETH has traded in a largely neutral pattern: upward momentum has stalled while trading volume continues to decline.

As a result, ETH remains confined to a wide range, with resistance around $4,868 and support near $4,000. Until price decisively breaks above resistance or below support, significant directional movement is unlikely.

The longer this consolidation persists, the greater the potential magnitude of the eventual breakout. Daily momentum indicators lean mildly bearish, but that outlook won’t be validated unless the $4,000 support gives way.

Ripple (XRP)

XRP is similarly range-bound, trading between roughly $3.00 and $3.20. Buyers managed to flip $3.00 into support in early September, but that bullish momentum has since faded and price sits near last week’s levels.

If demand does not re-emerge, XRP may revisit the $3.00 support. Multiple tests of a support level often signal weakening buyers and increase the probability of a breakdown, especially when volume is declining.

To keep the bullish case intact XRP needs to hold above $3.00; a convincing push above $3.20 would be required to reignite stronger upside interest.

Cardano (ADA)

Cardano climbed above $0.90 this week, but selling pressure is trying to push it back below that level. If sellers succeed, $0.90 will remain a resistance barrier for the near term.

Despite that pressure, ADA closed the week up about 2%, indicating that buyers are still present and could attempt to reclaim $0.90 as support. Regaining that level would pave the way toward $1.00 and higher targets.

Price action in this area looks compressed, suggesting a meaningful move is likely once either side gains control — bulls or bears will determine ADA’s next directional leg.

Binance Coin (BNB)

BNB pushed into four-digit territory this week, printing a new high at $1,007 — a notable milestone that helped it finish the week with roughly a 10% gain. That performance ranks BNB among the stronger performers this year.

With $1,000 now achieved, BNB’s next obvious upside target is around $1,200. If buyers defend the $1,000 area, it can act as support and the coin is likely to continue discovering higher prices while the broader market remains bullish.

HYPE (HYPE)

HYPE reached a fresh high this week at $59, but in the last 24 hours sellers stepped in and trimmed most of the gains. Buyers have pulled back to support zones around $56 and $52.

The $60 area remains resistance and has capped the most recent rally. Additionally, the daily MACD histogram shows a bearish divergence, which can be an early warning that a meaningful retracement may follow.

On the bigger picture, HYPE is still printing higher highs, which keeps the macro bias bullish. That view would be undermined if price breaks down below $50.

Overall, the market shows mixed signals: several assets are consolidating and waiting for volume to return, while others like BNB are breaking new ground. Watch the support and resistance levels highlighted above for clues on the next directional moves.