Recent on-chain data indicates a surge in Bitcoin holdings by new investors, suggesting that the latest price increase is fueled by new financial input.

First-Time Bitcoin Investors Elevate Supply by 2.86%

According to a recent post on X by analytics firm Glassnode, there’s a noticeable trend among Bitcoin’s ‘First Buyers.’ This group is part of Glassnode’s comprehensive categorization of investors based on their behavior. First-time buyers, as suggested by the name, are those acquiring Bitcoin for the first time. Thus, the supply linked to this group serves as an indicator of new capital entering the market.

Other categories in this behavioral classification include Momentum Buyers, who follow market trends, and Conviction Buyers, who purchase during price drops.

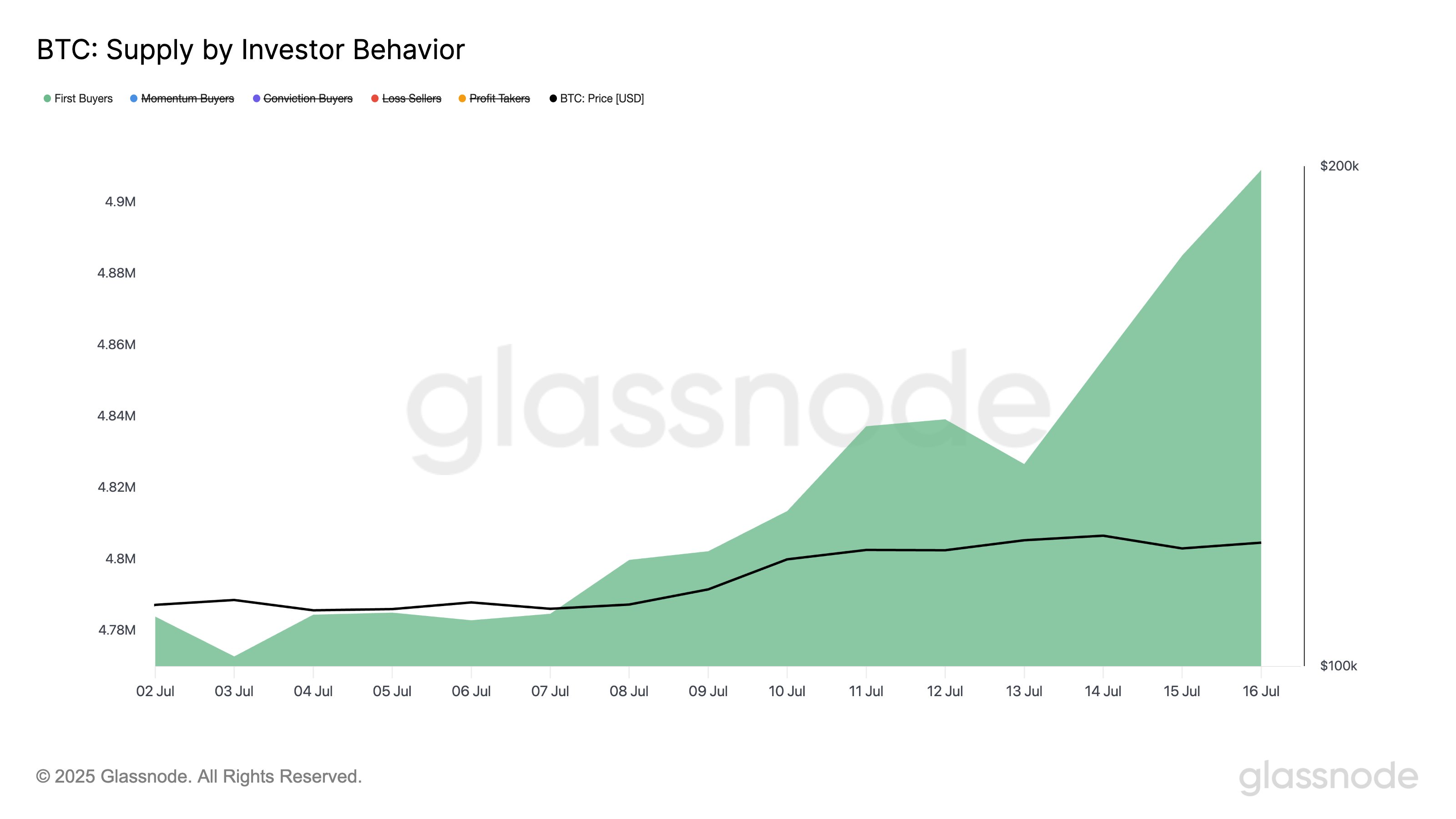

Below is a chart from the analytics firm illustrating the recent trend in Bitcoin supply held by First-Time Buyers over recent weeks.

As depicted in the chart, the supply held by Bitcoin First Buyers has increased over the past two weeks, indicating possible new capital inflow. Specifically, the holdings of this group have risen from 4.77 million BTC to 4.91 million BTC during this period, equating to an increase of approximately 140,000 coins or 2.86%. This suggests that the price rise to the new all-time high is supported by genuine demand.

In related news, the Bitcoin Puell Multiple has remained relatively stable despite the price increase, as noted by an analyst in a CryptoQuant Quicktake post.

The Puell Multiple is a metric that compares the daily value of coins ‘issued’ by miners (in USD) to the 365-day moving average (MA) of the same.

Essentially, this indicator shows whether Bitcoin miners are earning more from block subsidies compared to the average. Historically, when the indicator spikes, it often coincides with a peak in the cryptocurrency’s value.

As shown in the chart, the BTC Puell Multiple is currently around 1.2, indicating that miners are earning slightly more than the yearly average. If historical patterns hold, this might suggest there is still potential for growth in the current cycle.

However, it’s important to note that the peaks of this indicator have been decreasing with each cycle, meaning it could reach a lower peak in miner revenue this time.

Bitcoin Price

Bitcoin’s price recovery has been limited, with current trading levels around $117,000.