Analyst Miles Deutscher sparked a debate on August 19 regarding MicroStrategy’s market-implied net asset value (mNAV) premium, a key component in Michael Saylor’s Bitcoin acquisition strategy. Deutscher highlighted a significant compression in the mNAV premium, signaling a potential weakening of the feedback loop that once propelled the company’s outperformance of Bitcoin.

The Decline of MicroStrategy’s Bitcoin Premium

Deutscher emphasized the evolving perception of MicroStrategy, noting that while the company has a traditional software business generating revenue, its valuation is now heavily influenced by its Bitcoin holdings. The mNAV multiple, representing the premium investors pay for leveraged BTC exposure through MSTR, has decreased from 3.4x to 1.58x, indicating a slowdown in demand.

Concerns were further raised when Saylor announced revisions to MicroStrategy’s equity issuance strategy, potentially diluting shareholder value and increasing risk tied to Bitcoin’s volatility. The market’s response to this change has been divided, with some viewing it as a positive shift.

Analyzing a Potential Scenario

Deutscher illustrated a hypothetical scenario where a 20% decrease in Bitcoin’s price and a drop in the mNAV multiple to 1.0x could result in a significant decline in MicroStrategy’s stock value. This stress-test highlighted the company’s vulnerability to changes in Bitcoin’s value and the premium investors are willing to pay for exposure.

Deutscher also pointed out the impact of changing market dynamics on Bitcoin’s recent price weakness, attributing it to reduced demand from Saylor and the emergence of spot Bitcoin ETFs, offering a more direct way to invest in Bitcoin without the premium associated with owning MSTR.

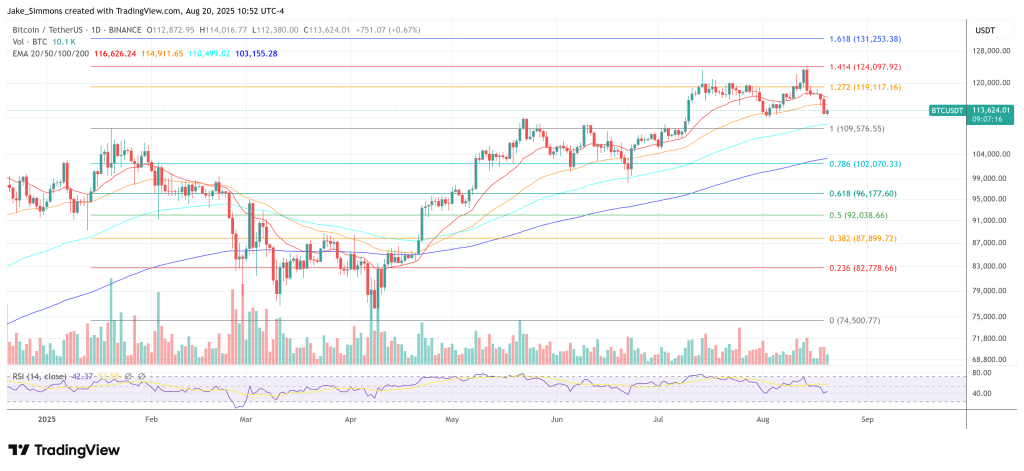

The evolving perception of the mNAV premium as a speculative element dependent on market confidence, capital market conditions, and leadership stability raises questions about its sustainability. As of the latest update, Bitcoin is trading at $113,624.