An Alabama state lawmaker is raising red flags about the potential fallout of the federal stablecoin law known as the GENIUS Act, warning that rural communities could face serious economic disruption.

Keith Kelley, a Republican representing Alabama’s 12th district, wrote in a Wednesday op-ed for 1819 News that the legislation contains a loophole that could “devastate” small-town economies. He argued that by allowing cryptocurrency platforms to distribute financial rewards, the law might incentivize depositors to pull money from community banks.

“Unlike large banks, community banks depend on local deposits to fund their lending,” Kelley said. “If those deposits decrease, their ability to offer loans to individuals, families, and small businesses will be significantly restricted.” He added that farming communities could be hit especially hard, since thin profit margins and seasonal cash flows often make local lending partners critical.

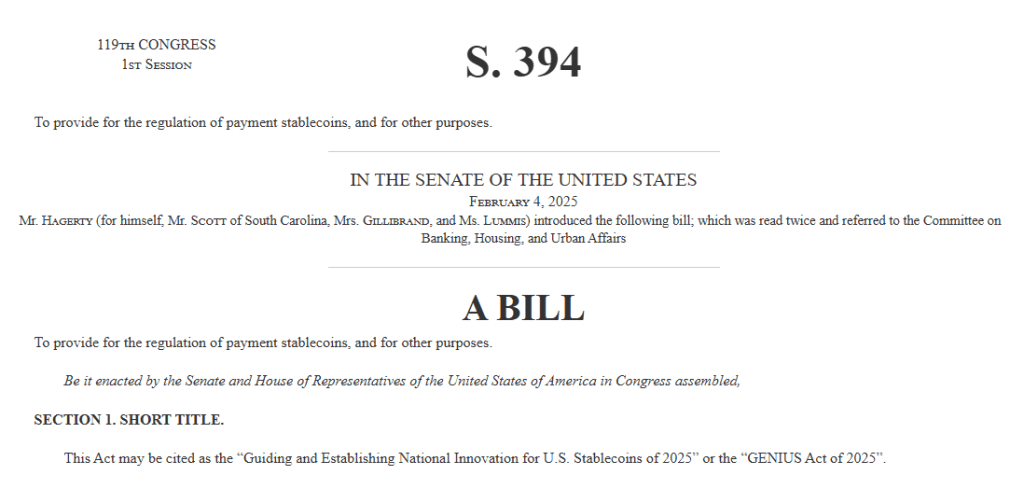

The GENIUS Act, signed into law by US President Donald Trump on July 18, establishes a regulatory framework for stablecoin issuers. While hailed by many as a step toward regulatory clarity and innovation, the law will only take effect once the US Treasury and Federal Reserve finalize rules. The Treasury began that process in August, inviting public feedback on illicit finance risks.

Critics, however, argue the law has significant blind spots. Timothy Massad, a Harvard researcher and former chair of the Commodity Futures Trading Commission, has warned that the so-called foreign issuer loophole could give overseas stablecoin issuers an unfair advantage by letting them operate under loosely defined “comparable” regulatory regimes.

Banking groups have echoed Kelley’s warnings. The Bank Policy Institute said in August the law could trigger up to $6.6 trillion in deposit outflows from traditional banks, squeezing credit access for smaller communities.

Kelley described the arrangement as “regulatory arbitrage,” where crypto platforms could offer yield-bearing products through affiliates without facing the same restrictions as banks. “Allowing these cryptocurrency companies to function like banks, offering rewards or yield-bearing products, without requiring them to play by the same rules is not innovation,” he said.

Although the GENIUS Act has strong support in Washington, the pushback from state-level voices like Kelley’s underscores the growing divide between the bill’s vision for innovation and concerns over financial stability at the local level.