Fitell shares fell 21% after announcing crypto strategy: the company bought $10M in Solana, but investors reacted negatively.

Fitell lost 21% after buying Solana for $10M

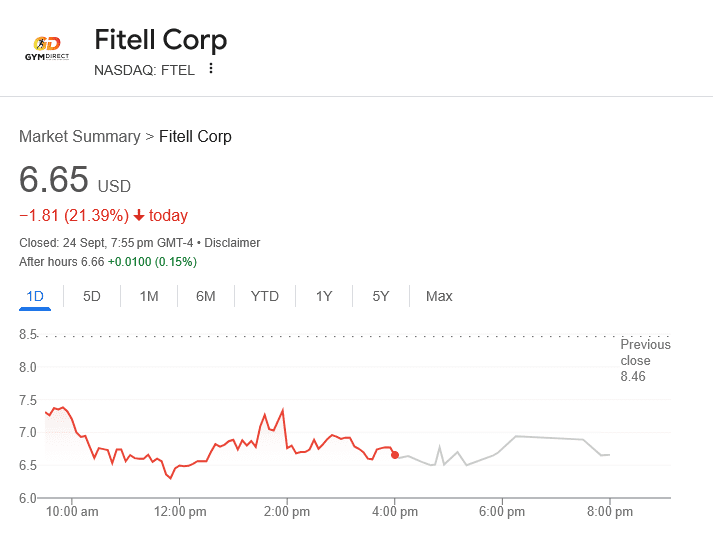

Australian fitness equipment manufacturer Fitell, whose shares are traded on the Nasdaq, announced a new treasury management strategy and bought more than 46,000 Solana tokens for $10M. But the market reacted sharply: the company’s shares fell 21% to close at $6.65.

Part of the “Solana-treasures” wave

Fitell became the fifth company this week whose crypto purchases were not appreciated by investors. For example, Helius Medical Technologies depreciated by 34% after buying $175M in Solana. CEA Industries, BitMine Immersion Technologies and Strategy Inc. also saw their shares fall between 2.5% and 19.5% after similar deals.

Fitell Strategy

The company issued a convertible bond for $100 million, 70% of which it plans to spend on cryptocurrency purchases, the rest on operations and working capital. CEO Sam Lu said that Fitell intends to expand its position in SOL and earn profits from staking.

Solana treasuries grow

According to Strategic SOL Reserve, 17 companies have already accumulated 17.04 million SOL — almost 3% of the total supply. Among them are Solmate, DeFi Development Corp and Helius, which have announced large-scale plans to form Solana reserves.

Related: Forward Industries Tokenizes Shares, Integrates With DeFi Solana