Yesterday marked a significant milestone for US Ethereum spot ETFs, with inflows reaching an all-time high, capturing the market’s attention. Ether’s price surged as both institutional and retail investors poured new capital into these financial instruments.

Inflows Reach New Heights

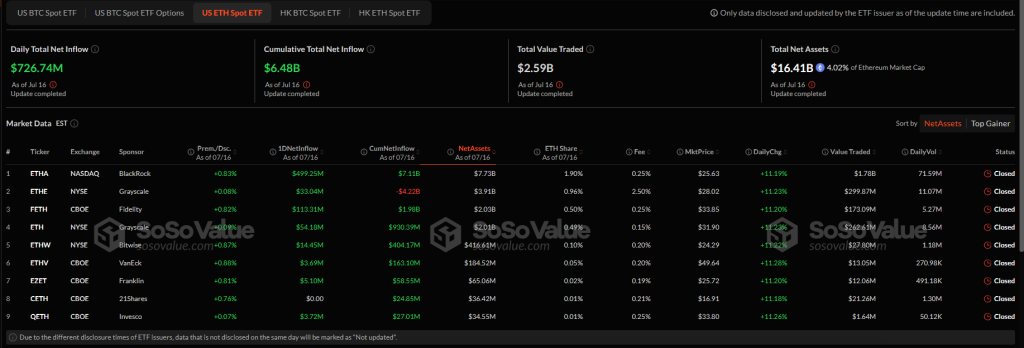

Recent data reveals that US Ethereum spot ETFs experienced a single-day inflow of $727 million yesterday, shattering the previous record of $428 million set on December 5.

The nine funds tracked have consistently attracted fresh investments for eight consecutive days leading up to this peak. Reports suggest this eight-day streak set the foundation for what turned out to be the largest single-day inflow in the ETFs’ history.

Major Players Drive the Trend

BlackRock’s iShares Ethereum Trust (ETHA) secured nearly $500 million on Wednesday, bringing its total net inflow to $7.11 billion since its inception. The Fidelity Ethereum Fund (FETH) closely followed, adding $113 million and increasing its total to nearly $2 billion.

Other funds also contributed: Grayscale’s Ethereum Trust (ETHE) received $54 million, Grayscale Mini Trust added $33 million, and Bitwise’s ETHW ETF brought in $14.5 million. These figures illustrate that both large institutions and individual investors are investing across various brands.

ETF Leaders Capture New Capital

Nate Geraci, president of ETF Stores, highlighted on social media that these ETFs have amassed nearly $2 billion over the past five trading days. This trend reflects the increasing confidence major players have in holding Ether through well-known financial structures. Retail investors often mirror institutional actions, suggesting these figures might trigger even more interest.

Ethereum’s Price Ascends

In the past 24 hours, Ether’s price has risen by 9%, currently trading at $3,430. Market data indicates that this level hasn’t been reached since January 31, when Ether last exceeded $3,370 before dropping below $1,500. This sharp increase highlights Ether’s sensitivity to substantial capital inflows into spot ETFs.

Positive Price Movement Sparks Optimism

Some analysts are now targeting $4,000 as Ether’s next significant milestone. The renewed vigor in this altcoin could potentially uplift other altcoins as well. If top-10 tokens follow Ether’s trajectory, the broader crypto market could experience further gains.

While strong inflows are promising, they don’t guarantee sustained gains. Inflows can quickly reverse if sentiment changes or if traders pursue profits too aggressively. However, the current outlook is optimistic. If inflows continue and the price stays above $3,300, reaching $4,000 might be within reach.

Featured image from Unsplash, chart from TradingView