The world’s second most valuable cryptocurrency, Ethereum, is currently experiencing significant delays for staking and unstaking transactions, a key feature sought by users.

The crypto community is abuzz with discussions regarding the unexpected bottleneck causing unprecedented wait times.

Unprecedented Wait Times

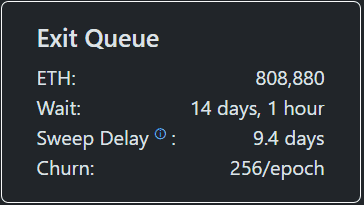

The Validator Queue for Ethereum, which signals interest in staking and unstaking, is witnessing an exit queue like never before. Presently, the wait time for unstaking is a remarkable 14 days, with 808,880 ETH valued at around $3.7 billion stuck due to the network hitting its epoch limit.

An epoch represents the time validators need to propose and verify block creation, averaging 6.4 minutes each. Churn dictates the volume of ETH that can move in and out per epoch, acting as a safeguard against instability. Meanwhile, sweep delay refers to the time taken for a withdrawal to reflect in the recipient’s wallet post-exit queue processing.

Comparatively, the queue for initiating ETH staking is half the length of the waiting list, currently at 374,136 ETH valued at approximately $1.7 billion, with a 6-day delay.

CryptoPotato recently highlighted a similar surge in exit queue activity, attributing it to a shift in investor strategies rather than mere profit-taking based on the altcoin’s price movements.

Identifying the Causes

The community is engaged in a lively discussion regarding the reasons behind the considerably prolonged unstaking wait times for Ethereum.

According to Marcin, co-founder of the Redstone oracle service, the issue might have originated from a previous spike in exit activity observed last month when Justin Sun, Tron’s founder, withdrew $600 million worth of ETH from the Aave protocol.

What happens when Justin Sun withdraws 600M of $ETH from Aave?

• ETH Borrow & Lend rates spike

• The backbone of DeFi, LST looping, is temporarily unprofitable

• The market stETH / ETH rate depegs ~0.3%

How DeFi’s biggest moves can suddenly spook leverage loopers pic.twitter.com/G1GesdZdEc

— Marcin | Lending Supercharged  (@MarcinRedStone) July 23, 2025

(@MarcinRedStone) July 23, 2025

One prevalent strategy involves staking ETH on Lido, a leading liquid staking platform, to receive stETH, which is then used on Aave for additional Ether borrowing, potentially leading to higher returns. The mass exodus likely occurred as traders followed Sun’s lead in closing out substantial positions.

An analyst suggested that the upcoming launch of ETH staking ETFs could have fueled the surge in unstaking, as investors readied themselves for these products following the SEC’s ruling declaring staking activities and liquid staking tokens as non-securities.

Profit-taking also played a role, with Ethereum nearing its previous all-time high of $4,891.70 from 2021, prompting numerous traders to lock in their gains amidst the rally.

The growing interest from treasury companies in the highest market capitalization altcoin might further contribute to the congestion, as they seek to reinvest their staked assets, exacerbating network traffic.

The post Ethereum Staking and Unstaking Delays Surge: 808,880 ETH Valued at $3.7B Stuck appeared first on CryptoPotato.

(@MarcinRedStone) July 23, 2025

(@MarcinRedStone) July 23, 2025