This week, Dogecoin enters trading with a precarious position on its long-term chart: technically strong, but visibly overextended. According to a series of weekly analyses by market expert Cantonese Cat, the meme coin is encountering resistance after a sharp two-week increase, which saw a nearly 80% gain from its June lows. The analyst warns that this upward movement, while structurally positive, might require a short-term correction for consolidation before resuming its upward trajectory.

Is Dogecoin Overextended?

In the logarithmic Fibonacci retracement spanning the 2024–25 range, last week’s candle managed to close slightly above the 0.618 level at $0.262, a point that has halted every breakout attempt since January. This close holds technical importance: in classical market analysis, reclaiming the 61.8% retracement often suggests a shift from recovery to trend growth.

“It surpassed the 0.618 log fib, which may need a bullish back-test,” Cantonese Cat noted, adding that revisiting that area “could lead to a pullback to retest” the double-bottom formed around $0.15 earlier in the quarter.

The Bollinger Band analysis highlights the risk of a near-term mean reversion. Dogecoin’s weekly close at $0.267 is its first in eleven months to settle outside the upper band, currently near $0.262. Such instances are rare on long-term charts and usually result in at least one subsequent candle re-entering the bands.

“It’s beyond the Bollinger band,” the analyst points out. Historically, Dogecoin has faced difficulty maintaining its position when this spread becomes too wide, often retracting to the middle band—now around $0.19—or, in stronger cycles, returning to the upper band the following week.

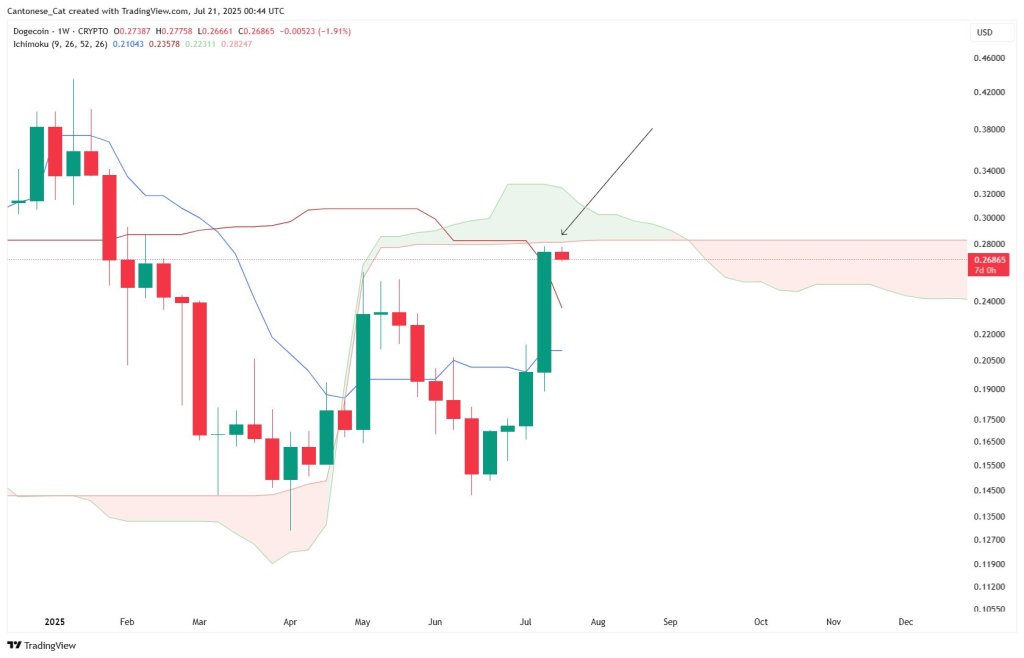

The Ichimoku chart also tells a story of progress meeting resistance. Prices have moved above both the conversion line (Tenkan-sen) and the baseline (Kijun-sen), indicating bullish momentum, yet remain below the weekly cloud’s lower boundary. The Senkō Span B, defining this boundary, is around $0.28–$0.29, nearly the point where Dogecoin halted at the end of last week.

Cantonese Cat describes this as “Ichimoku cloud resistance” and advises that until a decisive close breaks through the cloud, this level should be viewed as a supply zone. A brief dip could allow the Kijun-sen (approximately $0.23) and the 0.618 Fibonacci level to converge, providing a potential higher low.

Supporting this view is the grey supply-demand band on the fourth chart. It spans approximately $0.24 to $0.25 and aligns with the base of February’s breakdown range, acting as the neckline of the double-bottom referenced by Cantonese Cat.

A retracement to this former resistance-turned-support could meet both the Fibonacci back-test requirement and the Bollinger re-entry, while maintaining the broader reversal pattern. The analyst outlines this potential path on the chart: a pullback into the grey zone, followed by a push toward the mid-$0.30s.

Importantly, these observations do not negate the longer-term shift in market dynamics. The double-bottom near $0.15 resolved higher in July with a weekly candle that engulfed eleven weeks of prior supply, indicating a change from sellers to buyers. The recent candles, though smaller, have maintained every gain from that breakout. As the analyst concludes: “Overall, these are very bullish developments, even if a dip occurs early this week to reset some technical indicators.”

As of now, DOGE is trading at $0.277.