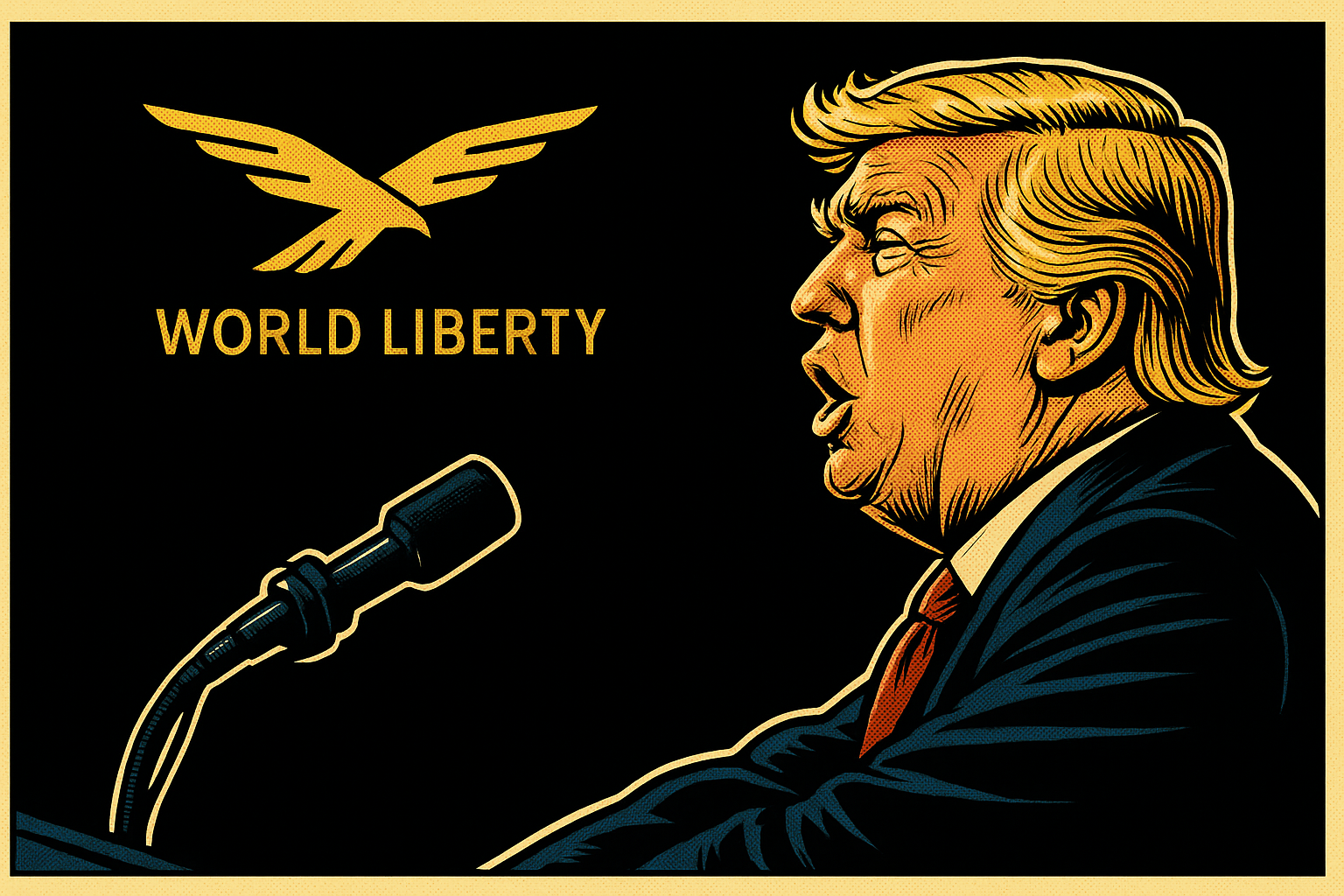

Aave’s governance token fell sharply on Saturday after rumors spread on social media about its potential allocation of tokens from World Liberty Financial (WLFI), a DeFi platform linked to members of U.S. President Donald Trump’s family.

The Aave (AAVE) token dropped more than 8%, sliding from around $385 to a low of $339 before recovering to roughly $352. The sell-off followed claims that Aave would receive 7% of WLFI’s token supply, which the WLFI team denied.

“The WLFI team told WuBlockchain that the claim that ‘Aave will receive 7% of the total WLFI token supply’ is false and fake news,” blockchain journalist Colin Wu reported on X.

The rumors appear to stem from an October 2024 WLFI community proposal, which outlined terms for the Aave DAO to receive 7% of WLFI governance tokens and 20% of revenues generated through WLFI’s deployment on Aave v3.

Aave founder Stani Kulechov addressed the matter on Saturday, calling the proposal “the art of the deal” and suggesting the terms remained valid. His remarks added to the confusion over whether the arrangement was binding.

The rumors and denial come as DeFi markets heat up again, with institutions showing renewed interest in yield-generating protocols. Still, the episode highlights the fragility of token prices in response to governance proposals and speculation.