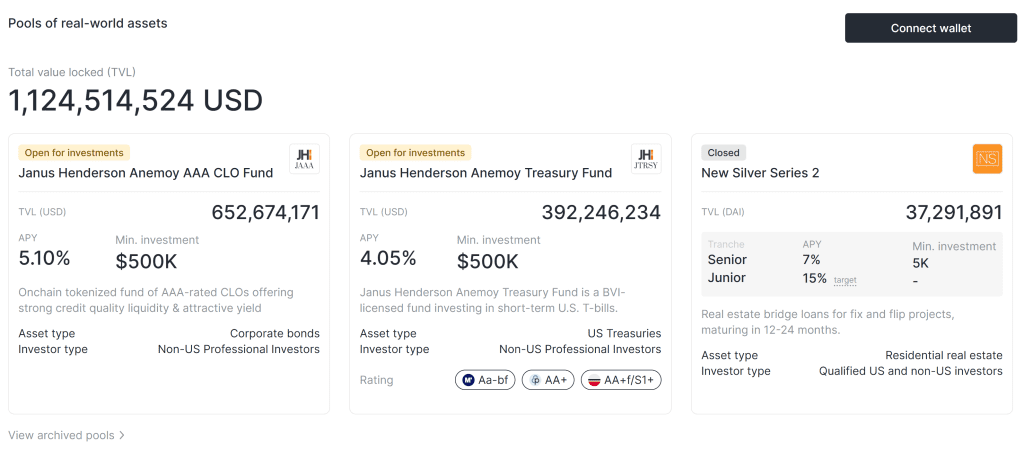

Blockchain platform Centrifuge has crossed $1 billion in total value locked (TVL), cementing its position alongside BlackRock’s BUIDL fund and Ondo Finance as one of only three real-world asset (RWA) platforms to reach the milestone.

CEO Bhaji Illuminati credited the surge to institutions shifting from pilot programs to “real deployments,” paired with growing appetite from onchain allocators.

“Markets need more than T-bills,” Illuminati told Cointelegraph, pointing to JAAA, an onchain version of Janus Henderson’s AAA-rated collateralized loan obligation (CLO) fund, as the next major step for yield-hungry investors. While U.S. Treasurys remain the dominant entry point for onchain capital, he noted JAAA is the fastest-growing tokenized product in its class.

Beyond Treasurys, Illuminati said private credit is emerging as a focal point, hinting at “more news soon” in that segment as institutions hunt for differentiated returns.

Tokenized S&P 500 demand

Earlier this summer, Centrifuge partnered with S&P Dow Jones Indices (S&P DJI) to launch a tokenized S&P 500 fund, structured as a regulated professional vehicle in the British Virgin Islands.

According to Illuminati, demand has been “very strong” even ahead of its official rollout, with an anchor pool of capital set to back the launch. He added that sector-specific and thematic indexes are next in line: “We see strong potential for sector and thematic index products to come onchain.”

S&P DJI’s own leadership recently confirmed it is in talks with exchanges, custodians and DeFi protocols to bring tokenized benchmarks to market. Stephanie Rowton, S&P DJI’s U.S. equities director, said the effort is designed to boost transparency, accessibility and investor confidence.

Expanding access through deRWA

Looking to broaden access, Centrifuge is preparing to launch deRWA, an initiative aimed at bringing tokenized assets to retail investors via exchanges, wallets, lending markets and DeFi integrations. These tokenized RWAs are engineered for composability and liquidity, making them easier to integrate into decentralized finance.

Illuminati expects public market RWAs like Treasurys and equities to dominate short-term adoption given their liquidity and familiarity, but predicts private markets will eventually lead as blockchain technology strips away inefficiencies and unlocks hidden value.

“Institutions are moving faster, allocators are scaling up, and the next phase is about taking RWAs beyond pilots to become a core part of portfolios,” Illuminati said.