Bitwise’s Matt Hougan warns that even if the SEC simplifies listing, not all crypto ETFs will be able to attract investors and money.

Bitwise: SEC may simplify crypto ETF listing, but success is not guaranteed

The SEC’s simplified listing process could open the door for a wave of new crypto ETFs in the US, but that doesn’t mean they will automatically attract capital.

Bitwise’s chief investment officer Matt Hougan said that “the introduction of common listing standards — which could come as early as October — is likely to bring in dozens of new crypto ETPs.” He stressed that such dynamics are consistent with the history of ETF launches in traditional finance.

“The fact of a launch does not mean success”

However, Hougan warned against confusing the emergence of new products with real demand for the assets:

“The mere existence of a crypto ETP does not guarantee significant inflows. You need fundamental interest in the asset,” he explained.

He said ETFs that are tied to assets like Bitcoin Cash will struggle to attract investors unless these coins get a new boost.

Success depends on the market

However, the launch of ETFs creates conditions for traditional investors to quickly access crypto assets when market conditions begin to improve. This could be an advantage at the time of a new growth cycle.

Earlier, Sygnum head of research Katharina Tischhauser noted that the market is full of expectations for new ETFs, but so far no one can explain where the real demand will come from.

New products are on the way

This week, the US is expected to launch two new ETFs on XRP and Dogecoin. And on July 3, the country’s first Solana staking ETF debuted, attracting $12 million in its first day — a result that Bloomberg analyst James Seyffart called a “healthy start.”

What the SEC Will Change

The SEC currently reviews each application for a spot crypto ETF individually, and the process can take up to 240 days with no guarantee of approval.

Under the new rules, Hougan said, applications that meet strict requirements will receive “virtually guaranteed approval” in up to 75 days.

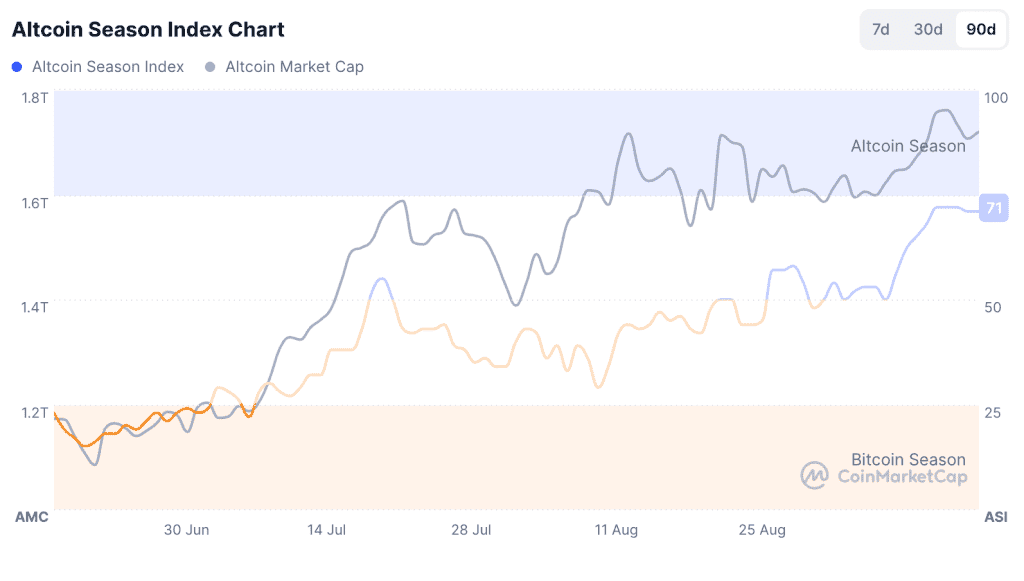

Bitfinex, in its review, emphasized that a large-scale altcoin rally should not be expected until ETFs are launched that give investors access to higher-risk assets.