Glassnode, a blockchain analytics firm, recently released its weekly report, offering insights into key metrics and on-chain data concerning the dominant cryptocurrency.

Spot Metrics

Bitcoin’s spot price exhibited a robust rebound in the past week, bouncing back from below $114,000 to around $121,000. This resurgence injected momentum into the spot market, signaling increased user activity across various sectors. However, vigilant monitoring of market conditions is advised.

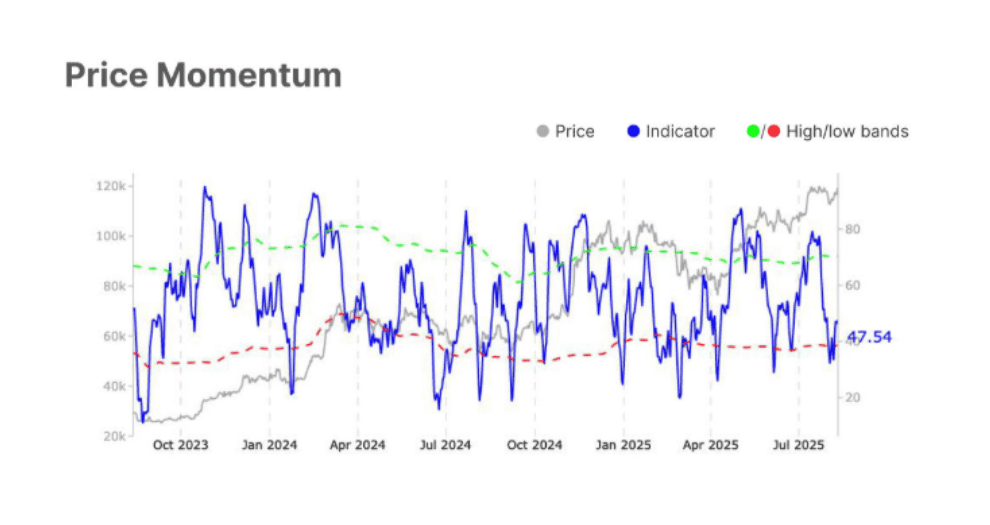

The Relative Strength Index (RSI), a gauge of price movement speed and change, rose to 47.5, marking a 14.5% uptick. This growth suggests rising investor interest and a potential shift towards a bullish trend. Yet, given the RSI’s position below the midpoint, sustaining this momentum is crucial to confirm the positive trend.

Despite the price rebound, Spot Volume dipped from $7.3 billion to $5.7 billion, indicating reduced market participation compared to prior weeks.

Futures Metrics

Open Interest, measuring active positions, decreased marginally from $44.6 billion to $44.1 billion, hinting at a modest decline in leveraged trading activities—possibly influenced by profit-taking or liquidation events.

The Funding Rate for long positions witnessed a 2% decline to $2.9 million, indicating a cooling bullish sentiment while sustaining demand for these positions.

Options Metrics

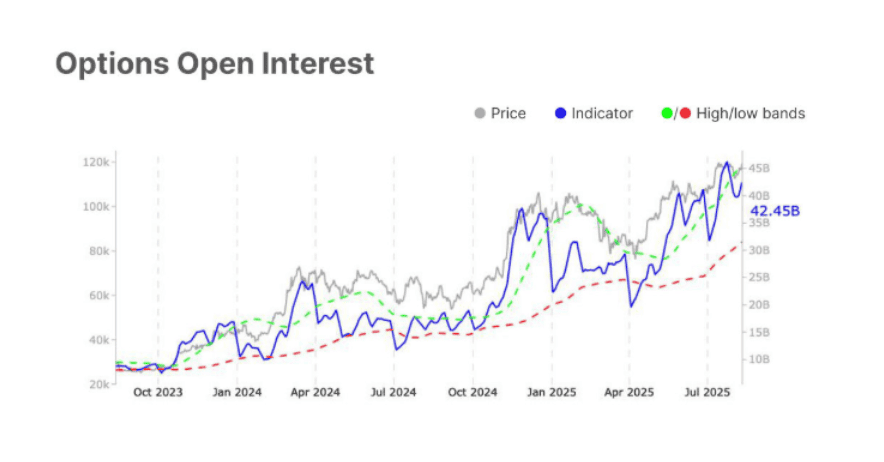

Options market Open Interest surged to $42.4 billion, outpacing futures growth by 6.74%. This rise reflects heightened market engagement driven by speculative trading strategies.

The Volatility Spread plunged from 31.97% to 10.45%, indicating traders’ anticipation of decreased market volatility.

US Spot ETFs

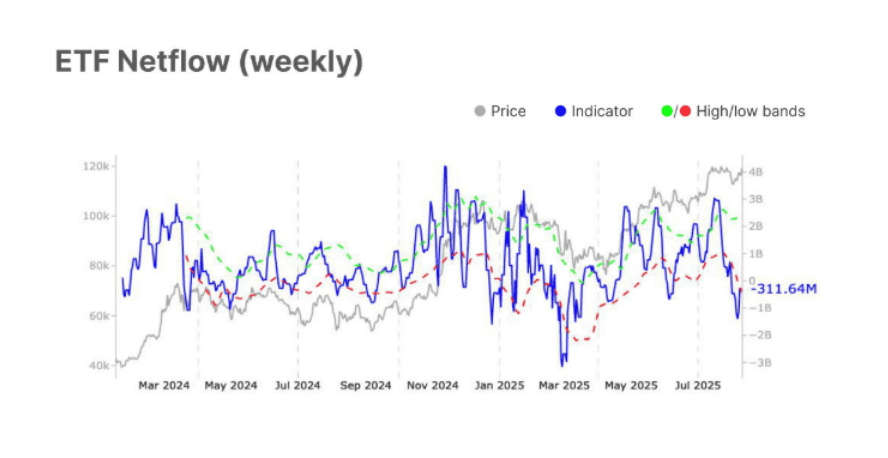

Encouragingly, weekly net flows in the ETF market surged by over 54%, shifting from -$686 million to -$311 million—a substantial reduction in outflows. This positive trend could signal a new phase of accumulation.

In contrast, Trade Volume witnessed a 27.7% decline to $13.7 billion, potentially indicating a market consolidation phase or waning seller activity.

Fundamental Metrics

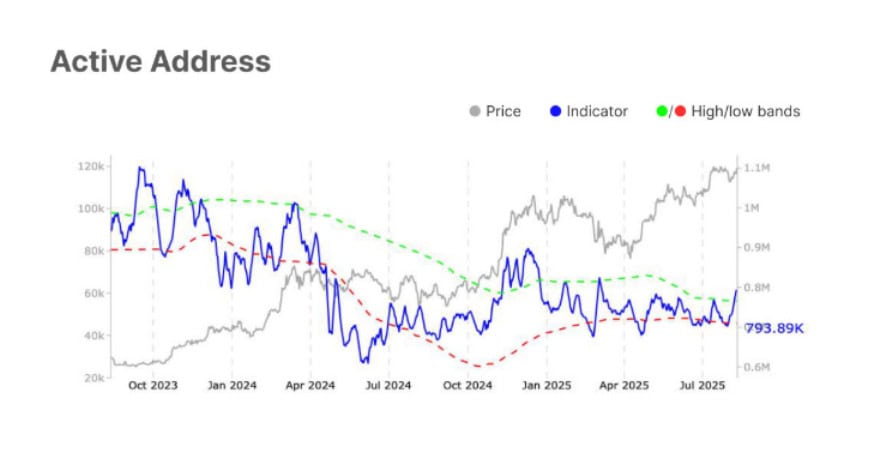

The count of daily active addresses rose to 793,000, signaling heightened user interaction with the network, possibly influenced by recent price shifts, hinting at a more active market phase ahead.

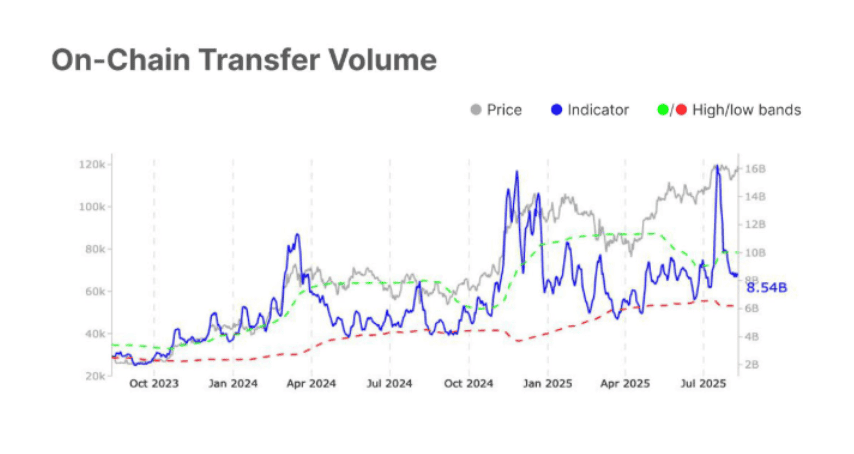

On-chain transfer volume saw a slight drop from $8.6 billion to $8.5 billion but maintained stability following a recent sharp decline, signaling renewed interest in transactions.

The latest data shows Bitcoin’s recent resurgence, but Glassnode cautions of potential challenges on the horizon.