Despite Warren Buffett’s praise for the S&P 500, Bitcoin has surged 1,473% since 2020 versus 106% for the index, underscoring crypto’s long-term edge.

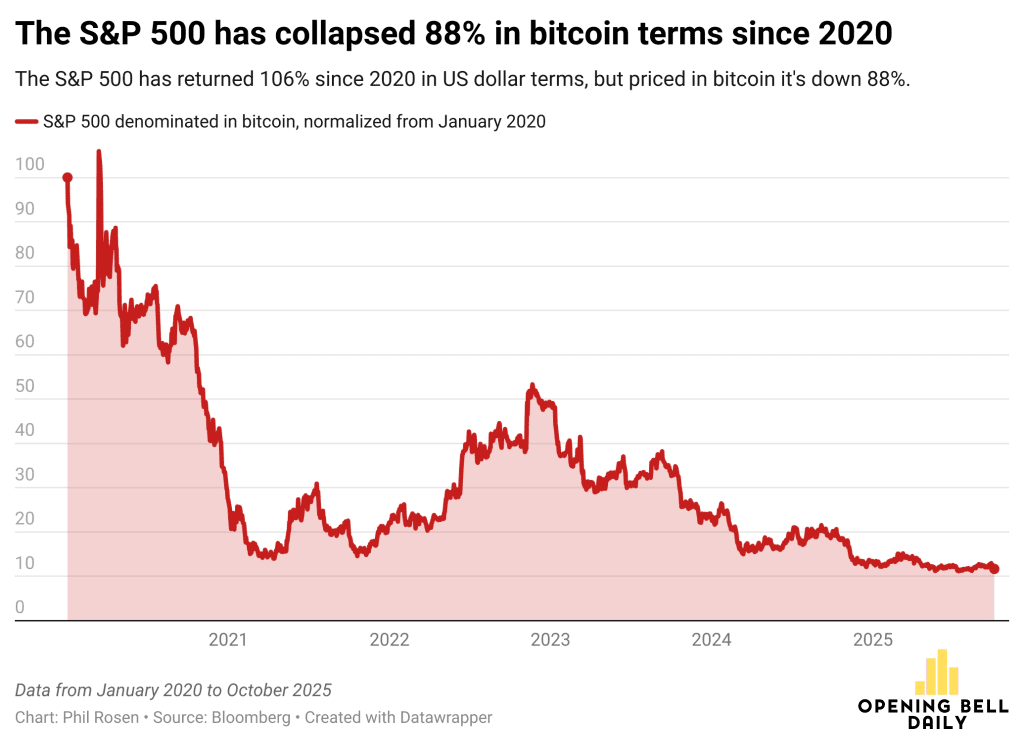

Bitcoin outpaces S&P 500 by 88% since 2020

Despite Warren Buffett’s years of advising investors to invest in the S&P 500, new data shows that since 2020 the index has lagged behind Bitcoin by 88%.

As Opening Bell Daily co-founder Phil Rosen noted, the index has risen by 106% in dollar terms, but in BTC terms its value has effectively “collapsed,” causing delight among Bitcoin enthusiasts.

S&P 500 and Bitcoin Set Records

The S&P 500 remains at all-time highs of $6,715.79, up 14.43% since the start of 2025.

Bitcoin, however, is outpacing even that pace, up 32% year-to-date and hitting a new ATH of $125,000.

According to OfficialData.org,

- $100 invested in the S&P 500 at the start of 2020 would be worth $209.85 today,

- and the same $100 in Bitcoin would be worth $1,473.87.

Why the comparison isn’t entirely accurate

The S&P 500 is a benchmark for the U.S. stock market that tracks the performance of the 500 largest publicly traded companies in the United States. It is a low-risk instrument that updates in real time and provides a stable average growth of ~6.7% per year, adjusted for inflation.

Bitcoin, on the other hand, is a separate digital asset based on scarcity, decentralization, and anti-crisis nature. Its volatility is much higher, but this is what makes it attractive to investors looking for an alternative to traditional financial instruments.

Two different eras of capital

- S&P 500 market cap: $56.7 trillion

- Bitcoin market cap: $2.47 trillion

Despite this difference, Bitcoin is becoming the new indicator of market confidence when the dollar weakens and inflation rises. And if Buffett believes in the power of indices, a new generation of investors believes in Bitcoin’s deflationary code.

Related: Dollar collapses as Bitcoin and gold hit record highs amid macro shift