Body:

Bitcoin is currently maintaining a position above the $115,000 mark following a record high of approximately $123,000 set last Monday. The price trend remains strongly positive, with buyers dominating the market, though indications of a possible short-term correction are emerging. The momentum has decelerated, and the market is entering a consolidation phase as traders reevaluate their risk exposure.

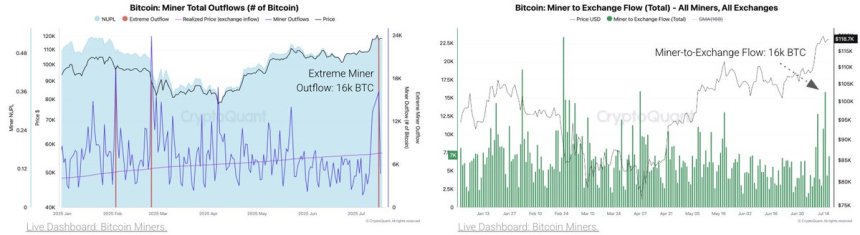

Recent statistics from CryptoQuant highlight a significant increase in Bitcoin miner sales. On July 15, coinciding with Bitcoin’s recent peak, daily BTC inflows to exchanges surged from 19,000 BTC to 81,000 BTC, indicating that major holders, such as miners and whales, are capitalizing on the high prices to sell off assets. Miner outflows notably rose to 16,000 BTC, marking the highest daily figure since April, with nearly all of it directed to exchanges.

These inflows reflect a change in sentiment among large-scale investors, increasing the likelihood of heightened supply pressure in the short term. While the general trend continues to be positive and fundamentals like long-term holder activity remain robust, the surge in exchange deposits is a classic warning sign. Whether this results in a more significant pullback or merely a healthy pause will likely be determined in the upcoming days.

Miners Cash In As Bitcoin Reaches Record High

New data from CryptoQuant indicates that Bitcoin miners have resumed significant selling as BTC attained a new peak of around $123,000. On July 15, miner outflows escalated to 16,000 BTC, the highest single-day amount since April 7. This spike in activity represents what CryptoQuant analysts describe as an “extreme outflow,” suggesting that miners are taking profits at these high price levels.

The miners transferred nearly all the BTC from their wallets directly to centralized exchanges, reinforcing that this was not merely a strategic reallocation but a decision to sell into market strength. Such actions often indicate growing caution among miners, who might anticipate near-term price fatigue or are simply taking advantage of favorable conditions after holding for months.

Miner behavior has long been viewed as a leading indicator of potential market changes. When outflows increase — particularly to exchanges — it often precedes higher volatility or temporary market tops. Although the broader Bitcoin trend remains upward and investor demand continues strong, this wave of miner sales introduces a layer of uncertainty.

Bitcoin Stabilizes Below Record Levels After Rapid Surge

The daily Bitcoin (BTC/USD) chart shows a price stabilization within a narrow range between $115,730 and $123,230 after achieving a new record high. This area now serves as a short-term channel, with buyers defending the $115K zone while facing resistance around $123K. The latest daily candle reflects low volatility, indicating indecision amongst traders as Bitcoin takes a breather following its recent breakout.

Volume has decreased following a sharp spike that occurred with the all-time high breakout, potentially signaling exhaustion or reduced participation from major buyers. The 50-day simple moving average (SMA) at $108,796 remains well below the current price, affirming the bullish momentum is still strong, but any fall below the $115K level could bring the 50-day SMA into focus as possible support.

Related Reading: All 40K Remaining Bitcoin From The 80K Whale Just Moved: $4.75B In One Wallet Now

So far, the trend structure remains bullish, but with an increasing number of analysts highlighting miner sales and whale activity, traders are keeping a close watch on price movements for signs of a pullback or renewed breakout. If BTC can reclaim $123,230 with significant volume, the next upward movement could occur. Until then, this consolidation might serve as a necessary cooldown before the next significant move.

Featured image from Dall-E, chart from TradingView