Bitcoin’s price could remain under pressure as long-term investors continue to lock in profits, analysts say. Amid the weak market recovery, traders are increasingly pointing not to manipulation or “paper BTC” but to the regular selling of old coins.

“It’s Just Sellers”

Analyst James Check said on Sunday that long-term selling remains an undervalued market. It is they who are the main source of current resistance for Bitcoin.

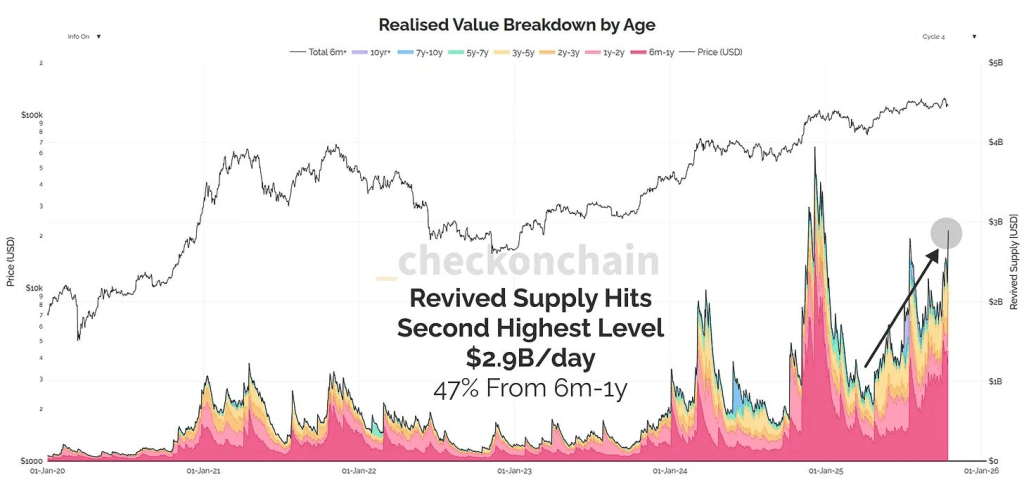

He showed a chart showing that the average age of coins sold is increasing, meaning old addresses have become more active. In addition, realized profits rose to $1.7 billion per day, while losses reached $430 million, the third highest figure of this cycle.

Another indicator — “revived supply,” that is, the volume of old coins that are re-entering circulation — rose to $2.9 billion per day, a near-record level.

OG sellers are changing the market

Investor Will Clemente emphasized that the last year of BTC weakness is the transfer of coins from “OG holders” to institutions, and this process is clearly visible on the blockchain.

“Over time, this factor will lose its importance, even if everyone is focused on the temporary weakness of BTC right now,” he noted.

Galaxy Digital CEO Mike Novogratz expressed a similar opinion. In an interview with Raul Pal, he said that many Bitcoin “veterans” decided to realize profits by investing in yachts or sports teams.

“People are cutting positions after a big rally — we’re just going through a redistribution phase,” Novogratz said, adding that the main source of supply right now is old players and miners.

Holding support is key

According to TradingView, Bitcoin ended the week with a close at $108,700, holding critical support.

Rekt Capital analyst believes that stability in this area could pave the way for a rally above $120,000 in the medium term. “Holding this level is absolutely key,” he stressed.

At the time of writing, BTC has recovered above $110,000, but is facing resistance just above that mark, which could determine the direction of the market in the coming weeks.

Related: US Bitcoin ETFs lose $1.2 billion, but Schwab remains optimistic