Bitcoin (BTC) remains steady in the upper $110,000s, yet on-chain indicators hint at a potential short-term price correction. Nevertheless, the overall market outlook continues to be strongly positive.

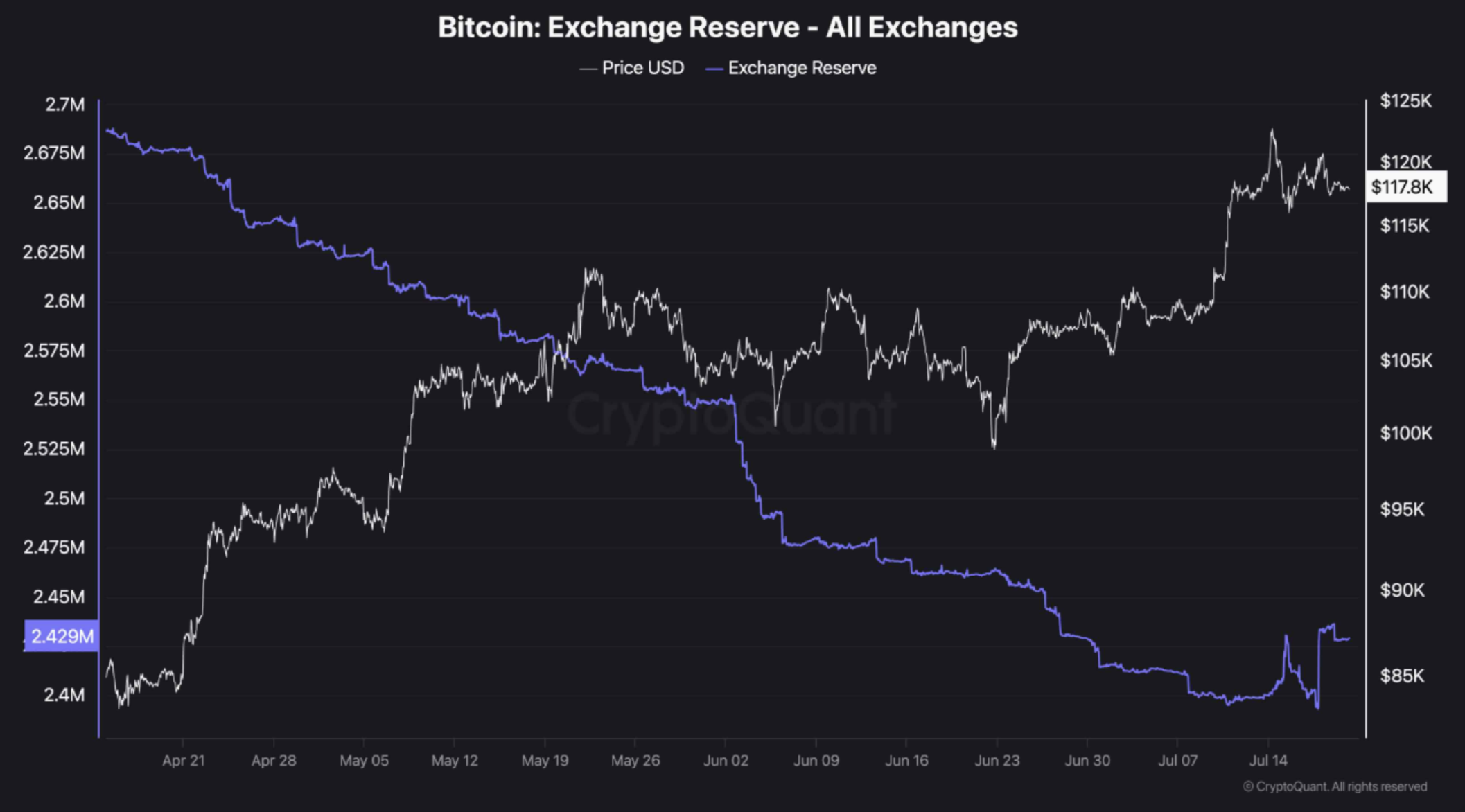

Bitcoin Holdings on Exchanges Reach Nearly a Month’s Peak

A recent update from CryptoQuant, shared by contributor ShayanMarkets, reveals that BTC reserves on centralized exchanges have reached their most elevated point since June 25. This increase might indicate that investors are looking to take profits.

When BTC inflows to exchanges rise, it often signals a distribution phase, as more coins are made available for possible sale. This change is typically viewed as a reduction in buy-side pressure, which might result in a short-term price dip. ShayanMarkets noted:

Historically, increased exchange reserves align with local market peaks, as more BTC becomes available for potential sale. However, this alone should not be considered a decisive factor for immediate price declines. Market liquidity, sentiment, and demand dynamics also play crucial roles.

The analyst stressed that while increased reserves might indicate short-term selling pressure, they do not necessarily signify a trend reversal. Any potential correction should be examined within the broader context, unless there is a significant shift in macroeconomic or technical indicators.

In another CryptoQuant post, analyst Darkfost highlighted a noticeable increase in activity from Bitcoin whales. Importantly, the last two Bitcoin local peaks coincided with monthly average inflows from whales surpassing $75 billion.

Between July 14 and July 18, average monthly inflows from whale wallets rose from $28 billion to $45 billion, marking a $17 billion increase. This trend suggests some whales might be capitalizing on Bitcoin’s recent record high of $123,218 on Binance.

Insights from On-Chain Data

On-chain analysis also reveals that long-term holders are distributing their BTC, while short-term holders are accumulating more. This type of behavior is typically seen during the late stages of a rally, possibly indicating exhaustion.

Despite this, the short-term holder Market Value to Realized Value (MVRV) ratio is currently at 1.15, which is still below the usual profit-taking threshold of 1.35. This implies that there could be room for further price growth before a wider selloff occurs.

Nonetheless, not all indicators are encouraging. The Bitcoin NVT Golden Cross—a measure comparing network value to transaction volume—is trending upwards, potentially signaling increased market speculation.

Similarly, data from Binance suggests that BTC might experience a short-term pullback. As of the latest update, Bitcoin is trading at $118,052, down 0.4% over the past 24 hours.