According to crypto analyst Josh Olszewicz, Bitcoin is expected to weather a challenging market in the next six weeks before potentially seeing improvements in the fourth quarter. Olszewicz highlights factors such as September seasonality, weakening momentum signals, and fluctuating ETF flows that call for cautious optimism and patience rather than aggressive leveraging.

Olszewicz emphasizes the importance of monitoring ETF flows and seasonality in shaping Bitcoin’s near-term outlook. He suggests that a period of stagnant ETF flows followed by a reset could pave the way for a more favorable fourth quarter. While corporate treasury buying has slowed, Olszewicz notes that the market is not overtly bearish but rather stuck in a phase of low momentum, expecting either sideways movement or short pullbacks in the coming weeks.

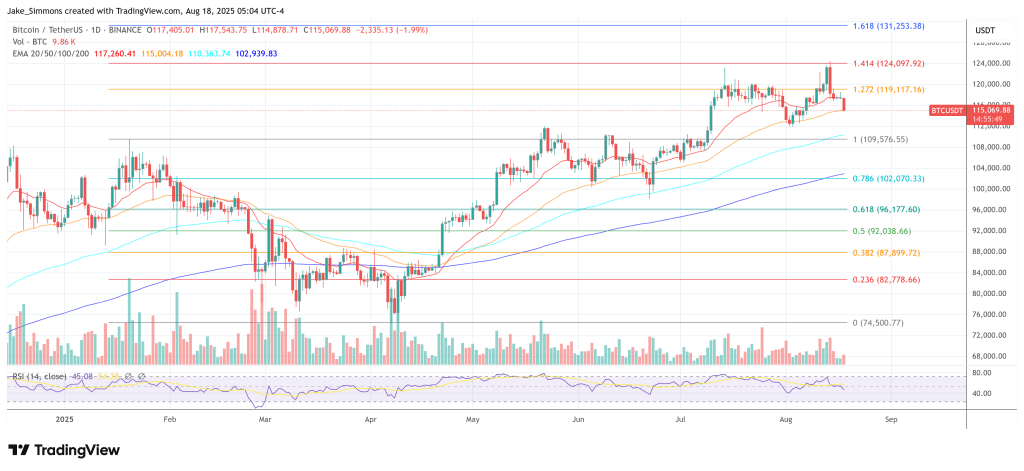

On the technical side, Olszewicz points to key levels on Bitcoin’s chart, particularly highlighting the significance of breaching the $121,000–$122,000 range for a potential upward trend. He also identifies specific triggers on the Ichimoku and trend indicators that could signal a shift in market sentiment, stressing the importance of a nuanced approach and confirmation signals rather than making outright predictions.

Looking ahead, Olszewicz mentions potential macroeconomic factors that could impact Bitcoin’s trajectory, such as Federal Reserve Chair Jerome Powell’s upcoming speech at Jackson Hole. While acknowledging short-term catalysts, he underscores the broader structural support for Bitcoin and other scarce assets amid increasing global money supply and debt levels.

Despite the challenges posed by September seasonality and market dynamics, Olszewicz remains cautiously optimistic about Bitcoin’s long-term prospects. He advises traders to watch for key technical levels and confirmation signals before expecting sustained upward momentum. Ultimately, he suggests that maintaining support levels and surpassing key resistance points could pave the way for Bitcoin to target $150,000 in the future.

As of the latest update, Bitcoin was trading at $115,069, with the market poised to navigate through the uncertainties of September towards a potentially brighter outlook for the fourth quarter.