Cathie Wood’s ARK Invest is doubling down on its bet that Ether will become a dominant institutional asset. On Monday, ARK scooped up 101,950 additional shares of Tom Lee’s Ether treasury firm BitMine Immersion Technologies (BMNR), worth roughly $4.4 million.

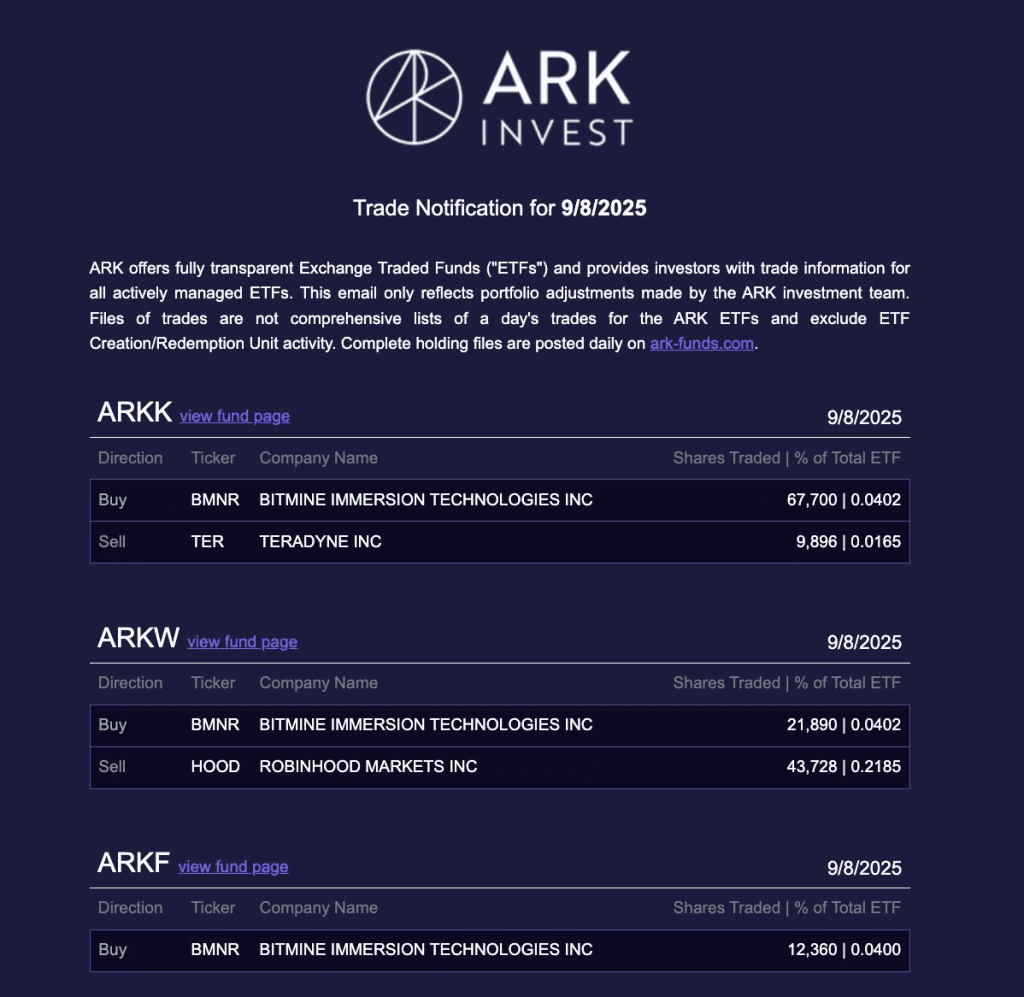

The purchase was spread across three of its funds: the Ark Innovation ETF, Ark Next Generation Internet ETF, and ARK Fintech Innovation ETF, all of which now hold similar allocations to BitMine. In total, ARK funds collectively own 6.7 million shares valued at $284 million, according to recent filings.

This latest buy coincided with BitMine announcing a landmark milestone: the company’s Ether treasury has now surpassed 2 million ETH, worth around $8.9 billion at current prices. That equates to 1.7% of Ethereum’s total supply, making BitMine by far the largest Ether treasury firm. Remarkably, it controls about 42% of the 4.9 million ETH currently held by corporations. BitMine has said it intends to reach 5% of ETH’s total supply, meaning it is only a third of the way toward its target.

The aggressive accumulation has paid off for BitMine shareholders. BMNR stock closed Monday up 4.1% at $44.10 in after-hours trading and has surged 460% since the start of the year. ARK has been steadily increasing its exposure since BitMine adopted its Ether treasury strategy in April, effectively treating Ethereum like a balance sheet reserve asset in the same way Michael Saylor’s Strategy has with Bitcoin.

Tom Lee, BitMine’s chairman, framed the ETH buildup as a generational trade. “We continue to believe Ethereum is one of the biggest macro trades over the next 10–15 years,” he said.

Lee also tied his optimism to U.S. macro conditions. Speaking on CNBC, he said he expects the Federal Reserve to cut interest rates next week, which he sees as a dual positive for both equities and crypto. “Fed cutting interest rates will have dual positives of lowering interest rates, particularly mortgage rates could fall, and boosting biz confidence,” he noted.

Prediction markets currently price in an 89.4% chance of a 25 basis point cut and a 10.6% chance of a larger 50 basis point cut. If realized, Lee argued, that liquidity boost could set the stage for Ethereum to benefit alongside smaller-cap equities.

While ETH’s price action remains rangebound this month, the sheer scale of BitMine’s treasury growth, combined with institutional buying from ARK and others, signals mounting conviction that Ethereum could cement itself as a cornerstone of the next macro cycle.