Tokenization of real-world assets (RWAs) has surged to record levels this year, with Web3 property firm Animoca Brands forecasting that the sector could eventually represent trillions of dollars in value from traditional finance.

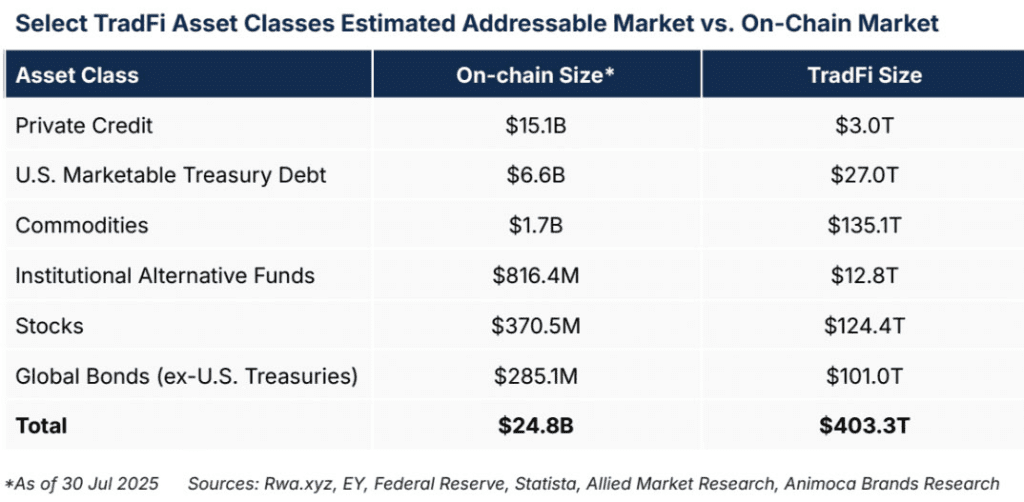

In an August research paper, Animoca researchers Andrew Ho and Ming Ruan estimated the “addressable market” for RWA tokenization at more than $400 trillion, encompassing private credit, treasury debt, commodities, equities, alternative funds, and global bonds. By comparison, the tokenized RWA market currently sits at just $26.5 billion, according to industry tracker RWA.xyz, only a fraction of its potential but already at an all-time high.

“The estimated $400 trillion addressable TradFi market underscores the potential growth runway for RWA tokenization,” the researchers said, noting that the market has expanded by more than 70% since the start of 2025.

Animoca pointed to growing institutional activity and what it described as “a strategic race to build full-stack, integrated platforms” led by large asset managers. Long-term value, the report said, will accrue to platforms that can control the full asset lifecycle, from issuance to settlement.

Currently, private credit and U.S. Treasurys dominate the tokenized landscape, together representing nearly 90% of the market. Ethereum remains the leading blockchain for RWA tokenization, accounting for 55% of market share when stablecoins are included. Factoring in Ethereum layer-2 networks such as Arbitrum, Polygon, and ZKsync Era, its dominance grows to 76%.

“Its leading position is likely due to its security, liquidity, and the largest ecosystem of developers and DeFi applications,” the researchers wrote.

The report added that rising tokenization could also spur demand for related crypto assets such as Ether (ETH) — which hit an all-time high of $4,645 on Sunday — and oracle provider Chainlink (LINK), both of which have outperformed the broader crypto market in recent weeks.

Animoca said RWA tokenization is “unfolding across a multichain ecosystem” that includes both public and private blockchains. While Ethereum has a clear lead today, purpose-built networks are beginning to challenge its position, suggesting that interoperability will be key as the sector scales.

Earlier this month, Animoca launched its own RWA marketplace, NUVA, signaling the firm’s deeper push into the rapidly expanding sector.