Article Text:

Market analyst Dr. Cat, using a pseudonym, has detailed a well-reasoned plan suggesting XRP could potentially triple its value from the current figures, reaching between six to ten dollars over the upcoming two months—on the condition that Bitcoin continues its upward trajectory to $144,000.

XRP Could Reach $10 Under Certain Conditions

Over the weekend, the analyst highlighted in a series of posts that the monthly chart of XRP against BTC is “coiling” just below a significant Ichimoku Cloud level at 2,674 satoshis. “Should this month close above 2,674, I anticipate a rise to at least 4,135 in the coming months,” Dr. Cat stated, suggesting that such a close would mark the first bullish monthly kumo twist for the pair since 2018, placing XRP in an unusual “support-and-regain” pattern for altcoins in the current market cycle.

The 4,135–7,600 satoshi range is identified by Dr. Cat as the “resistance/take-profit zone.” He suggests that prices rarely reload immediately after such extensive breakouts, and a spike to the upper boundary of this range is likely once momentum builds.

“If BTC ascends to 144K in this weekly movement, XRP’s price in USD terms could range between $6 and $10,” the analyst mentioned to followers, estimating the shift for August or September if Bitcoin’s trend intensifies. Dr. Cat acknowledged that the optimal risk-reward ratio diminishes beyond 7,600 sats—posing the question, “Would you risk a 10× unrealized gain for an additional 0.7×?”—and indicated plans to exit the position despite potential long-term targets above $30 being “possible” by 2026.

The XRP‑USD chart also shows a promising outlook. Sunday’s weekly close above $3.37 elevated both the cloud and the Kijun-sen, resulting in a textbook Chikou Span breakout during week 27 of the Ichimoku time cycle, known as the Henka-Bi candle.

Dr. Cat’s price projection grid integrates traditional Fibonacci extensions with Ichimoku price measurement theory: the N-wave goal is $4.53, the E-wave is $6.31, and the 2E extension is $9.22. “Given this weekly close’s condition, all of these targets are feasible within the next month or two, with $4.5 being the absolute minimum,” he noted, recalling the same $4.5 target was perceived as the “minimum” when XRP was valued at $1.89 in early April.

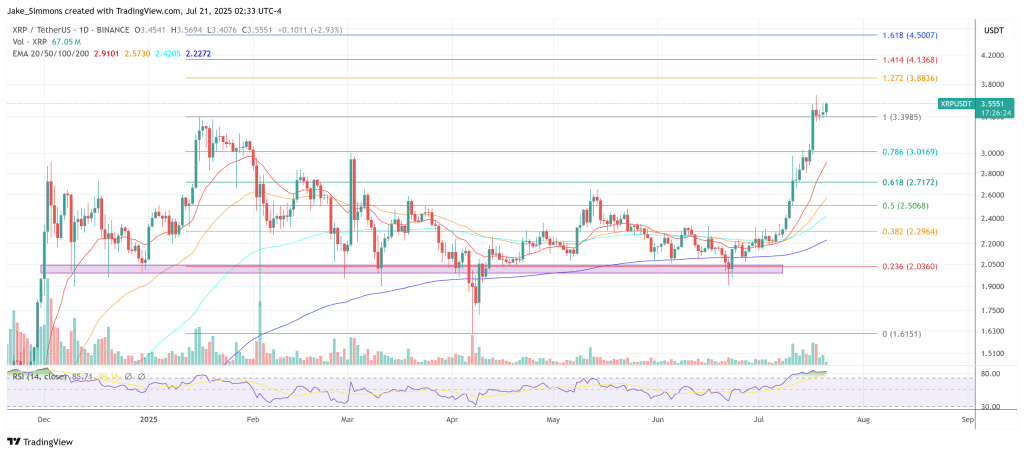

The market context offers some support to this thesis. Bitcoin is trading just above $118,500 after a subdued weekend session, consolidating a 20 percent rally since early July, while Ether is near $3,760 and dominance continues to shift in favor of large-cap altcoins. XRP is around $3.55 after a 50-percent weekly surge.

Technically, securing a “monthly close above 2,674 sats” remains crucial. Failing to achieve this level would delay the kumo twist and risk an extended period of range-bound movement against Bitcoin. Conversely, a decisive move into the 4,135–7,600 satoshi range would confirm the first bullish market structure change on the long-term ratio chart in seven years, likely driving speculative flows into the XRP-USD pair.

Traders seeking further confirmation will monitor whether the Chikou Span can surpass price on the weekly timeframe “this or next week”—a rare but potent signal that the analyst warns could override the “healthy cross” caveat and propel the market vertically even before the textbook Tenkan-Kijun crossover appears.

Currently, the path to $6–$10 largely depends on Bitcoin’s capability to continue its surge toward the six-figure mark. If Bitcoin stalls below $120,000, the potential upside for XRP diminishes; however, if the rally persists, Dr. Cat’s combined Ichimoku-Fibonacci targets suggest that $4.5 would be the initial milestone, followed swiftly by $6, with the much-anticipated $10 mark becoming “feasible” as the cloud twist, time cycle symmetry, and momentum align.

At the time of writing, XRP was trading at $3.55.