World Liberty Financial (WLFI), the Trump family–backed crypto project, has turned to token burning in an attempt to stabilize its price after a rocky first week of public trading.

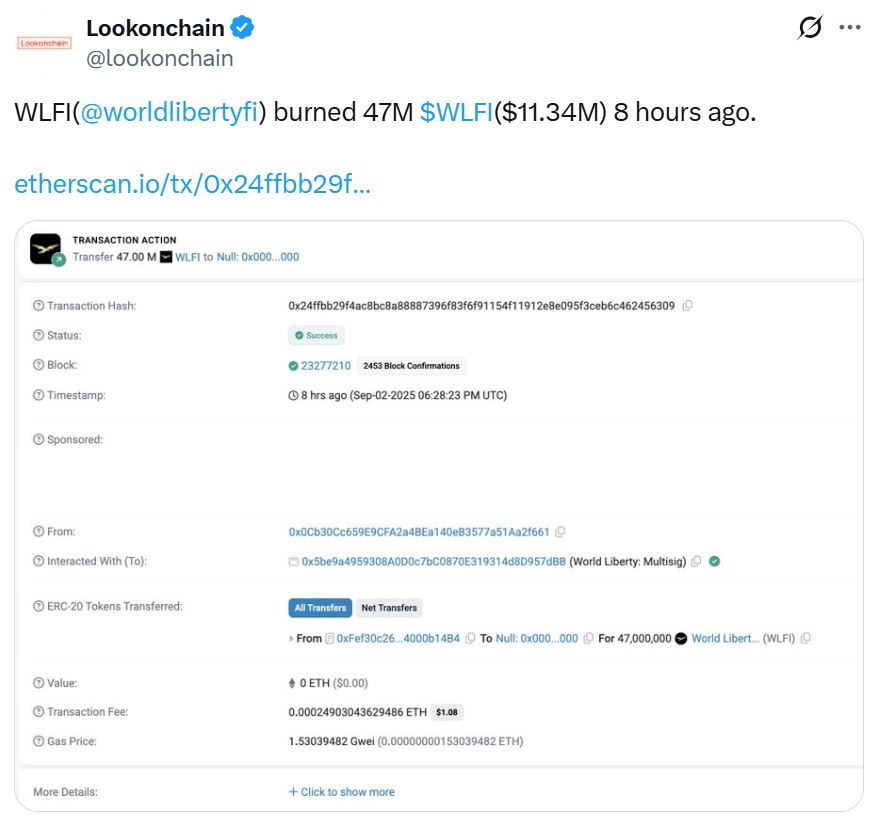

Onchain data shows that 47 million WLFI tokens were permanently destroyed on Sept. 2, reducing the total supply to just over 99.95 billion, according to Etherscan. The burn represents roughly 0.19% of the 24.66 billion tokens currently in circulation.

WLFI launched on major exchanges Monday, including Binance and Coinbase, after early investors gained the right to sell their allocations. The token briefly spiked to $0.331 but has since slumped more than 31%, now trading at around $0.23. The sell-off has been attributed in part to heavy shorting activity, prompting the project to seek ways to boost scarcity and restore momentum.

A governance proposal published Tuesday outlined a broader plan to direct all protocol-owned liquidity fees from WLFI’s operations on Ethereum, BNB Chain, and Solana toward a permanent buyback-and-burn program. The team argued that such measures would increase the relative share of long-term holders while removing tokens “held by participants not committed to WLFI’s growth.”

The idea appears to have community backing: a majority of the 133 comments under the proposal expressed approval, though an official vote has yet to take place.

Market observers, however, voiced skepticism. Kevin Rusher, founder of the real-world asset lending platform RAAC, said the WLFI hype underscores crypto’s immaturity. “Celebrity tokens or short-term hype don’t build resilience. Institutional adoption and sound design do,” he warned.

Others noted the project’s impact on Ethereum’s infrastructure. Mangirdas Ptašinskas, head of marketing at Galxe, pointed out that WLFI trading activity pushed Ethereum gas fees “into the stratosphere,” with $200 transfers briefly costing $50. He called it a reminder that “our job is still far from done” if crypto wants to achieve mainstream adoption.

For now, the WLFI team is betting that token burns can stem the decline and encourage investor confidence. Whether the strategy proves effective depends on whether the project can sustain demand beyond its high-profile political backing and early speculative fervor.