Metaplanet, Japan’s largest corporate Bitcoin holder, announced Monday it had purchased another 1,009 BTC for 16.48 billion yen ($112 million), pushing its total holdings to 20,000 BTC.

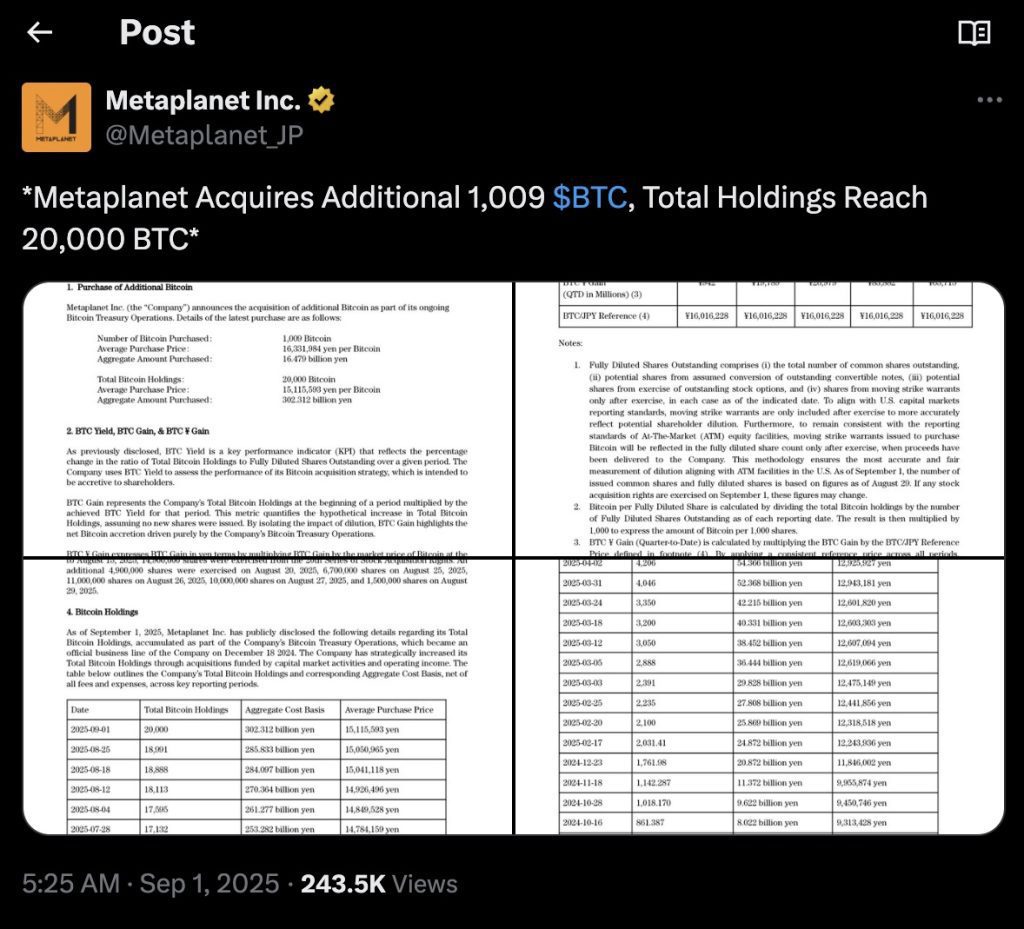

According to the company’s filing, the latest acquisition was made at an average price of $111,068 per Bitcoin. The milestone makes Metaplanet the sixth-largest public Bitcoin treasury worldwide, likely overtaking U.S.-based Riot Platforms, according to data from Bitcointreasuries.net.

The expansion comes at breakneck speed. Metaplanet doubled its stack from 10,000 BTC to 20,000 BTC in less than three months, after revising its year-end target to 30,000 BTC earlier this year. That adjustment tripled its initial 2025 goal of 10,000 BTC, signaling a far more aggressive accumulation strategy.

The firm is also preparing a major fundraising round to accelerate its buying. Last week, it announced plans to raise 130 billion yen (about $880 million) through an overseas share sale, with most of the proceeds earmarked for Bitcoin purchases over the next two months.

CEO Simon Gerovich has indicated that Metaplanet may eventually borrow against its Bitcoin reserves to finance acquisitions of cash-generating businesses, expanding beyond its current treasury strategy.

Despite the aggressive buying, Metaplanet’s Tokyo-listed shares slipped 2.62% on Monday morning, according to Yahoo Finance. Its U.S.-listed stock closed last Friday at $6.11, up 0.83% on the day.

Metaplanet now joins the ranks of the biggest Bitcoin treasuries, trailing only giants like Michael Saylor’s MicroStrategy, which holds over 632,000 BTC.