A16z Crypto has invested $50 million in Solana’s Jito protocol, which provides SOL liquid staking. The investment is expected to strengthen the Solana ecosystem and spur the development of DeFi.

A16z Crypto Invests $50 Million in Jito, Solana’s Liquid Staking Protocol

A16z Crypto, the blockchain arm of venture capital firm Andreessen Horowitz, has invested $50 million in Jito, a liquid staking protocol that plays a key role in the operation of the Solana network.

According to Fortune, the deal involves a16z acquiring a portion of its JTO tokens at a discount.

“This investment will enable the Jito Foundation to make Solana the home of internet finance for the next decade,” said Brian Smith, the foundation’s executive director.

What is Jito

Jito is a Solana-based liquid staking protocol launched in 2022. It allows users to stake SOL tokens for rewards while maintaining liquidity through the JitoSOL token.

- The Jito Foundation is responsible for the management and distribution of the tokens.

- Jito Labs is the primary developer and operator of the infrastructure.

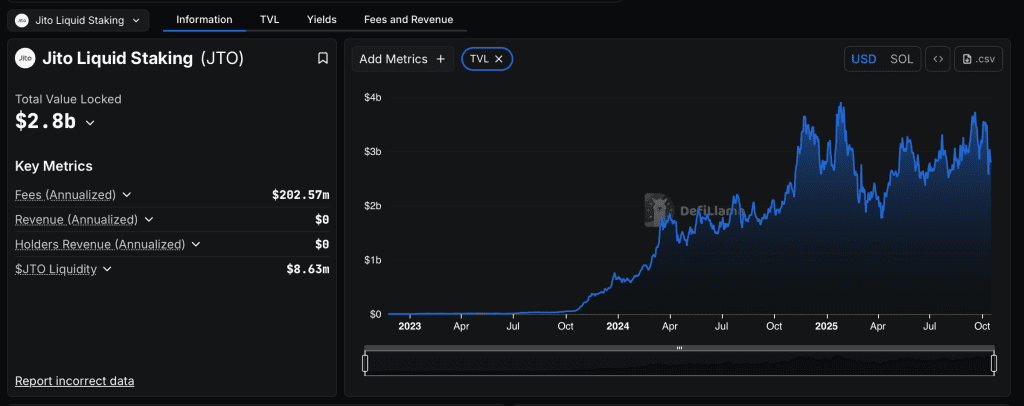

Jito currently has $2.8 billion in TVL, according to DefiLlama, making it the leading Solana protocol (compared to Marinade at $1.9 billion, Lido on Ethereum at $33.9 billion).

Context: Liquid Staking and Regulation

In 2025, liquid staking became a hot topic of discussion between the crypto industry and U.S. regulators. The process allows users to profit from staking while also having a tradable derivative of the token that can be used in DeFi.

Rebecca Rettig, Jito Labs’ general counsel, led a team that first met with the Trump administration to clarify the legal status of liquid staking. Her work could pave the way for JitoSOL to be included in ETFs and ETPs, which is “a key element of the bull case for JTO.”

In late July, Jito Labs, along with VanEck and Bitwise, urged the SEC to allow liquid staking in Solana-ETPs.

In August, the U.S. Securities and Exchange Commission issued guidance that recognizes some forms of liquid staking as non-securities, but “it all depends on the specific circumstances.”

A16z Increases Investment in Web3

The investment in Jito is part of a16z Crypto’s active expansion into Web3 infrastructure:

- April 2025: $55 million in LayerZero (cross-chain protocol).

- Same month: $25M in Miden, a ZK blockchain from Polygon Labs.

A16z already has a portfolio of projects in decentralized finance, Web3, and zk technologies, and the investment in Jito solidifies its influence in the Solana ecosystem.

Outlook

Despite regulatory uncertainty, liquid staking is becoming a foundation of DeFi. Solana is actively competing with Ethereum in this space, and a16z’s investment in Jito could accelerate the emergence of new products — from staking-based ETFs to next-generation Solana capital markets.

Related: Bitwise CIO: Solana could become Wall Street’s blockchain for stablecoins